Invoice disputes are a headache that many companies know all too well. They’re the frustrating, time-consuming issues that pop up when mismatched data, unclear terms, or missing documentation throw a wrench in the works.

Whether you’re in finance, procurement, or operations, the impact can be felt across departments: delayed payments, poor vendor relationships, and backlogs of unresolved issues.

But it doesn’t have to be this way.

What if there were a way to automate and streamline this process intelligently, accurately, and efficiently?

Enter Power Automate, a tool that transforms how invoice disputes are handled, making them faster, more accurate, and far less stressful.

In this post, we’ll walk through how automation can turn invoice dispute resolution from a bottleneck into a smooth, efficient process that keeps everyone, including vendors and internal teams, on the same page.

Understanding Invoice Disputes: Challenges and the Need for Automation in Finance and Procurement

Invoice disputes are a persistent issue across industries, especially in large-scale finance and procurement operations.

These disputes can arise from a variety of factors, including mismatched invoice data, unclear or ambiguous payment terms, missing or incomplete documentation, or discrepancies between the goods/services ordered and delivered.

Regardless of the cause, these issues can cause significant delays and friction between vendors, finance teams, and operational systems.

The Causes of Invoice Disputes

- Mismatched Invoice Data: Errors in amounts, tax calculations, or incorrect vendor details often lead to discrepancies that require resolution.

- Unclear Payment Terms: Vague or conflicting payment terms between businesses and vendors can result in confusion regarding payment deadlines or discounts.

- Missing Documentation: Incomplete paperwork, such as purchase orders or receipts, often leaves gaps in understanding, leading to delays in processing invoices.

- Discrepancies Between Goods/Services Ordered vs. Delivered: If the delivered goods or services do not match what was ordered, the vendor and buyer may need to resolve the issue before payment can be processed.

The Traditional Manual Resolution Process

In traditional invoice dispute resolution processes, these challenges are often handled manually, requiring several steps:

- Communication and Back-and-Forth: Vendors, finance teams, and procurement departments must communicate frequently to clarify issues, often through emails, phone calls, or even physical mail.

- Manual Data Entry and Verification: Staff members manually input, cross-check, and verify invoice details with purchase orders, contracts, and delivery receipts.

- Documentation Gathering: In many cases, multiple documents need to be retrieved from different systems or departments, leading to time-consuming searches and administrative overhead.

- Escalation for Review: If a dispute cannot be quickly resolved, it may need to be escalated to management, requiring additional time and approval layers before a resolution is reached.

These manual methods create a slow, error-prone process that can span several days or even weeks to resolve a single dispute, and they often lead to the following challenges:

The Consequences of Inefficient Invoice Dispute Resolution

- Delayed Payments: The extended time it takes to resolve disputes can result in delayed payments to vendors, impacting both relationships and business operations. Delays can also lead to penalties or late fees.

- Poor Vendor Relationships: Frequent invoice disputes and slow resolution times can damage trust and goodwill with vendors, making it harder to negotiate favorable terms or secure discounts in the future.

- Internal Process Bottlenecks: Inefficiencies in dispute resolution can cause workflow bottlenecks within the finance and procurement teams. This not only reduces productivity but also increases the strain on team members who must deal with the backlog of unresolved issues.

- Regulatory and Audit Risks: The lack of a structured, automated process increases the risk of non-compliance with financial regulations, as manual processes are more prone to errors. Additionally, during audits, tracking and reporting on dispute resolution processes can be challenging, leading to potential issues with transparency.

Given these challenges, it’s clear that traditional methods of resolving invoice disputes are no longer sufficient. The process needs to be more efficient, accurate, and traceable to reduce the operational costs, delays, and risks associated with manual workflows.

Bitcot’s Low-Code Solution for Automating Invoice Dispute Resolution with Power Automate

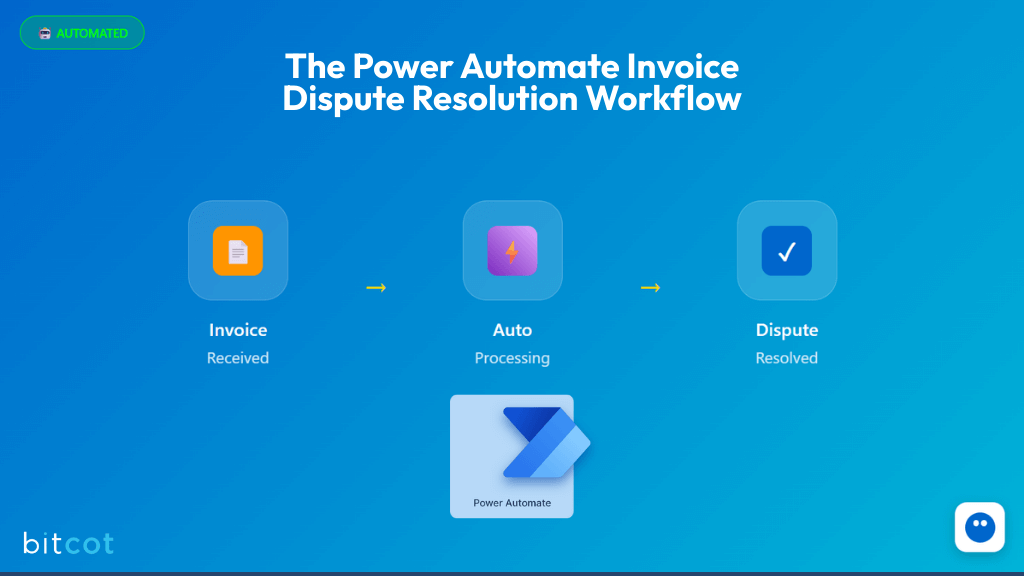

To overcome the challenges of manual invoice dispute resolution, businesses are increasingly turning to automation. Microsoft Power Automate offers a comprehensive solution for streamlining the entire process, making it faster, more accurate, and less prone to human error.

Power Automate enables a custom, end-to-end solution that simplifies and accelerates the invoice dispute resolution process.

By leveraging the Power Platform’s capabilities, such as AI Builder, Dataverse, SharePoint, Outlook, Teams, and Approvals, organizations can automate every stage of the invoice dispute lifecycle. Each stage plays a vital role in ensuring speed, traceability, and data integrity.

Below are the key workflow stages to automate:

Step 1: Dispute Intake & Classification

The dispute intake process is the first critical stage in handling any business dispute. Disputes can originate from multiple sources, including vendor submissions, internal forms, document uploads, and external API integrations. These varied inputs require a flexible system for seamless processing and classification.

Sources of Dispute Submissions:

- Vendor Email Submissions: Vendors may submit disputes directly via email, often including attachments like invoices or dispute letters.

- Internal User Forms (Power Apps): Internal employees can raise disputes manually using forms powered by Microsoft Power Apps, designed to standardize the dispute reporting process.

- Document Uploads (SharePoint): Disputes may also be raised through direct document uploads to SharePoint folders, ensuring all relevant materials are centralized in one location.

- External API Integrations: Disputes originating from external sources, such as ERP or supplier portals, can be captured through API integrations, ensuring smooth data flow and reducing manual handling.

Recommended Triggers for Intake:

- When a new email arrives (V3): Outlook triggers the flow when a new vendor email is received.

- When a new item is created: A SharePoint trigger starts the flow whenever a new dispute-related document is uploaded.

- Power Apps: Used for manual dispute entries.

- When an HTTP request is received: External systems can trigger the intake process via API calls.

Each of these triggers initiates a cloud flow that gathers submission metadata and files, setting the stage for downstream dispute processing.

Step 2: AI-Driven Context Extraction

Reducing manual data entry is a key objective in improving dispute handling efficiency. AI-driven tools, like AI Builder, are used to extract and classify data from various document types, minimizing human intervention.

Sources for AI-Driven Extraction:

- PDFs or Scanned Documents: The AI can parse PDFs or scanned documents to extract relevant information, such as invoice details.

- Structured Forms: Forms with clearly defined fields (e.g., invoices, purchase orders) are easily processed for data extraction.

- Email Bodies: AI can analyze the contents of dispute-related emails to extract important data points.

Key Actions in Data Extraction:

- Extract Information: The AI focuses on extracting critical data from invoices or dispute letters, including invoice numbers, vendor information, and dispute reasons.

- Predict: AI is used to classify dispute types automatically, such as identifying overcharges, duplicate charges, or late deliveries.

- Parse JSON: After extracting data, the AI’s output is structured into JSON format for further logic application.

Fields Typically Extracted:

- Invoice Number

- Vendor ID / Name

- Invoice Amount

- Date of Service

- Dispute Reason

- PO Number

- Attached Documents

The extracted data is temporarily stored in SharePoint, Excel, or Dataverse, providing a centralized location for further processing.

Step 3: System Validation & Cross-Reference

After the data is extracted, the next step is to validate it by cross-checking with internal finance records to ensure its accuracy. This ensures the dispute is legitimate and that the amounts align with existing records.

Validation Process Includes:

- Invoice Matching: Confirm that the invoice in question exists in the internal records.

- Amount Validation: Ensure that the invoice amount matches the amount in the dispute.

- PO Fulfillment: Check that the corresponding purchase order (PO) has been fulfilled as per contract.

- Vendor Verification: Confirm that the vendor in the dispute matches a recognized and verified supplier.

Key Actions in System Validation:

- Get Item: SharePoint pulls up the relevant invoice log.

- Get Row: Excel Online is queried for data from legacy systems.

- Get a Row by ID: Dataverse is used for structured data extraction.

- HTTP Call: API calls to ERP or finance systems validate the data against the organization’s financial records.

Validation Logic Includes:

- Does the invoice match the PO?

- Has the invoice already been paid or disputed?

- Was the delivery completed as per the agreement?

These validations separate disputes that can be resolved immediately from those that need further investigation, ensuring more efficient processing.

Step 4: Decision Logic: Resolve or Escalate

Once the validation is complete, the system applies decision logic to either resolve the dispute automatically or escalate it for further investigation.

Automated Resolution:

If all the data checks out (i.e., the invoice and PO match, and no other issues are found), the system can auto-resolve the dispute and notify the necessary parties.

Escalation:

If the data is incomplete or conflicting, the dispute is flagged for escalation. The system automatically routes these disputes to the appropriate team member or stakeholder for further review.

Control Actions for Decision Logic:

- Condition: Simple logic branches that guide the flow based on matching criteria.

- Switch: More complex decision trees for handling various dispute types and outcomes.

Escalated disputes are tagged with metadata (such as value thresholds) to route them to the right department (e.g., high-value disputes are sent to a finance manager).

Step 5: Human Review & Escalation

For disputes that require manual intervention, an approval process is triggered. This allows the relevant team members, such as the finance team, to review the extracted data and determine the appropriate next steps.

Approval Process Setup:

- Start and Wait for an Approval: An approval request is sent to the designated team.

- Post Adaptive Card: Teams can respond directly within Microsoft Teams.

- Email Approval Links: Reviewers receive emails with links to approve or reject the dispute.

Reviewer Actions:

- Approve: Proceed with the resolution steps.

- Reject: Request additional information.

- Mark as Invalid: Close the dispute if the case is not legitimate.

Feedback from reviewers is logged for transparency and future reference, and final actions are recorded in the dispute’s history.

Step 6: Resolution Execution

Once a dispute has been approved for resolution, Power Automate triggers the appropriate actions to close the case, ensuring all steps are followed and recorded.

Resolution Actions:

- Update Invoice Records: Update ERP systems or databases with the resolved dispute details.

- Create Dispute Tickets: Generate records in external systems like Salesforce or SAP.

- Notify Vendor: Communicate with the vendor regarding the resolution of the dispute.

- Payment/Cancellation Processing: Route the document for payment or cancellation as needed.

Actions Taken:

- Update Item: SharePoint is updated with the resolution.

- Update Row: Excel or Dataverse records are modified.

- Send Email: Notifications are sent to submitters, vendors, or managers.

- Create Record: A record is created in the integrated system for tracking.

This stage ensures the dispute is fully resolved and that the necessary follow-up actions are taken.

Step 7: Logging, Communication & Reporting

For audit purposes and long-term analysis, all actions and decisions taken throughout the dispute resolution process are logged. These logs are stored securely for future reference, and reports are generated for ongoing monitoring and trend analysis.

Log Storage Locations:

- SharePoint List

- Dataverse Table

- SQL or Excel Workbook

- Microsoft Lists

Reporting Tools:

- Power BI: Dashboards track dispute trends and resolution performance.

- Power Automate Flow History: Monitor the execution and performance of the flow.

- PDF Summaries: Dispute summaries are converted into PDFs and emailed to relevant stakeholders.

Logging Actions:

- Create HTML Table: Summarize disputes in a structured format.

- Populate Word Template: Generate formatted reports.

- Convert to PDF: Generate PDFs from Word documents for distribution.

- Send Email: Send final reports to leadership teams.

- Add Row to Table: Archive records for future reference.

This final step ensures transparency, accountability, and continuous improvement in the dispute resolution process.

Final Thoughts

This end-to-end Power Automate workflow really changes the game when it comes to managing invoice disputes. Blending smart automation with structured checks and human oversight makes handling disputes quicker, smoother, and way more accurate.

Here’s why it matters:

- Faster Resolutions: The system speeds up everything from intake to approval, so disputes get resolved much quicker without all the back-and-forth. No more getting stuck in a pile of paperwork.

- Maintaining Vendor Trust: Vendors don’t like waiting around or feeling like their issues aren’t being taken seriously. With this workflow, disputes are handled efficiently, keeping vendors happy and relationships strong.

- Fewer Errors: Automation means fewer chances for manual mistakes, like typos or wrong data entries. Everything’s processed more accurately, which cuts down on the risk of costly errors.

- Keeping Things Compliant: The structured process makes sure everything’s in line with regulatory requirements. Since every step is tracked, audits become a breeze.

- Better Reporting: With real-time tracking, you’ve got full visibility into how disputes are handled. You can see trends, monitor how well the process is working, and make informed decisions based on solid data.

Whether it’s just for the finance team or scaled up across different departments, this system helps reduce the friction that usually slows things down. It frees up your team’s time, keeps things running smoothly, and ultimately adds more value to your operations.

If you’re looking to take your dispute management to the next level and streamline your processes, our Power Platform development services can help you implement this end-to-end custom invoice dispute resolution solution.

Reach out to Bitcot today, and let’s talk about how we can help you create a smarter, faster, and more accurate dispute resolution process.