If you’ve ever worked in the world of social security or insurance claims, you know how tricky it can be to separate genuine cases from fraudulent ones.

Every day, agencies handle mountains of disability claims, each with its own set of documents, medical records, and personal details. And while most claims are legitimate, a small percentage of fraudulent submissions can cause huge financial losses and erode public trust.

Think about it: false medical documents, duplicate claims made under different names, or exaggerated disability conditions aren’t just paperwork issues. They slow down processing for real claimants who truly need support. Worse yet, these schemes can go undetected for months if the review process is manual or inconsistent.

That’s where automation steps in.

With Microsoft Power Automate, organizations can streamline claim verification, flag suspicious patterns, and strengthen fraud detection without bogging down staff in tedious manual reviews.

By integrating data from multiple systems, applying rule-based logic, and triggering alerts automatically, Power Automate helps catch red flags early, ensuring legitimate claims are processed quickly while potential fraud gets the scrutiny it deserves.

In this post, we’ll walk through a Power Automate solution designed specifically to detect and manage fraud risks in disability claims, turning a complex, error-prone process into a smarter, faster, and more secure workflow.

Challenges of Traditional Fraud Detection in Disability Claims

Traditionally, fraud detection in disability claims has been a painstakingly manual process.

Claims officers and auditors pore over stacks of paperwork, medical reports, and supporting evidence, trying to spot inconsistencies or red flags by eye. While their expertise is invaluable, the sheer volume of claims makes it nearly impossible to catch every suspicious case in time.

The result?

A process that’s:

- Slow: The manual review process is time-consuming, especially when claims are complex, involve multiple documents, or have incomplete or unclear information. For each claim, officers must carefully cross-reference a variety of records, which often leads to delays. Fraud is frequently spotted only after benefits have been paid out.

- Resource-Intensive: Detecting fraud manually means relying on large teams of claims officers, auditors, and investigators to carefully review each case. This highly resource-heavy approach not only drives up operational costs but also stretches staff capacity. As more claims flood in, agencies are forced to hire and train more personnel, resulting in increased labor costs.

- Reactive: Fraud detection in the traditional process tends to be reactive rather than proactive. By the time fraudulent claims are discovered, payments have often already been disbursed. This means agencies are often playing catch-up, focusing more on damage control than preventing fraud in real-time. The focus shifts to investigating cases after the fact.

In short, traditional fraud detection methods simply can’t keep up with the speed and sophistication of today’s fraudulent schemes. Agencies need smarter tools that can work proactively, catching suspicious patterns before money leaves the system, and that’s where automation comes in.

With the right technology in place, agencies can streamline their processes, identify fraud earlier, and improve efficiency, ultimately saving time, resources, and money. Leveraging automation can help them stay ahead of fraudsters and better protect taxpayer dollars.

How Power Automate Transforms Fraud Detection in Disability Claims

A Power Automate-driven orchestration solution seamlessly blends automation, AI, and human oversight to create a powerful system that improves the accuracy, efficiency, and speed of disability claims processing.

Here’s how it works step by step:

1. Ingest Disability Claim Data from Multiple Sources

In the world of disability claims, data doesn’t just come from one place. It’s spread across various systems: medical records, identity verification systems, insurance databases, and more. Power Automate can automatically collect and aggregate this data from multiple sources—no more manual data entry or wasted time trying to pull information together.

Whether it’s from external systems, emails, or online portals, the system consolidates all the claim data in one place, giving you a single source of truth to work with. This eliminates errors that can occur when data is entered manually and ensures you have all the necessary details to process a claim quickly and accurately.

2. Apply Fraud Detection Algorithms to Flag Suspicious Claims

Once the data is in the system, Power Automate leverages fraud detection algorithms powered by AI to instantly assess each claim for potential red flags. These algorithms analyze patterns, cross-reference data, and use historical information to identify discrepancies that may indicate fraud.

For example, it might spot duplicate claims, false medical documentation, or fabricated disability conditions that human reviewers might miss. By automating this process, the solution can sift through vast amounts of data much faster than any manual process, flagging potentially suspicious claims in real time for further investigation.

3. Categorize Fraud Risks Based on Severity

Not all fraud risks are created equal. Some claims might involve minor discrepancies, while others may be major fraudulent activities. With Power Automate, fraud risks are automatically categorized based on their severity. The system can analyze the flagged claims, assessing the potential impact of each issue.

For example, a claim with minor inconsistencies in medical records might be marked as low risk, while a claim with multiple red flags, like mismatched identities or fabricated documents, would be categorized as high risk. This prioritization helps teams focus their attention where it’s most needed, ensuring that more critical cases get the right level of scrutiny.

4. Escalate High-Risk Claims for Human Investigation

While AI can do a lot, there are times when human judgment is essential. Power Automate ensures that high-risk claims, those that pose a significant threat, are escalated to human investigators or claims officers. This ensures that the most suspicious cases get a thorough review by someone with the expertise to make a final determination.

For instance, if a claim has multiple inconsistencies or involves a person with a history of fraudulent behavior, the system will flag it for immediate human intervention. This combination of automation and human oversight allows for more efficient and accurate decision-making while still leveraging the speed of automation.

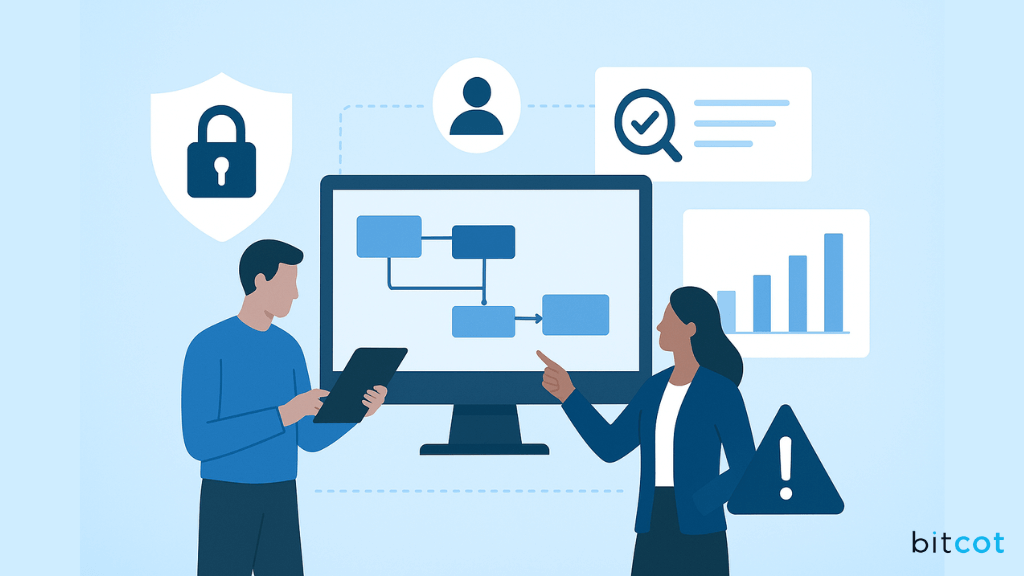

5. Ensure Compliance and Auditing Through Structured Record-Keeping

Compliance and auditing are non-negotiable in disability claims processing. With Power Automate, every step of the claims process is logged and documented in a structured and easily accessible format. This ensures that you always have a complete audit trail, whether it’s for regulatory compliance or internal audits.

Whether it’s tracking when data was ingested, when fraud detection was applied, or when a claim was flagged for escalation, everything is captured automatically. This not only reduces the risk of non-compliance but also saves time by making it easy to access records for review at any time.

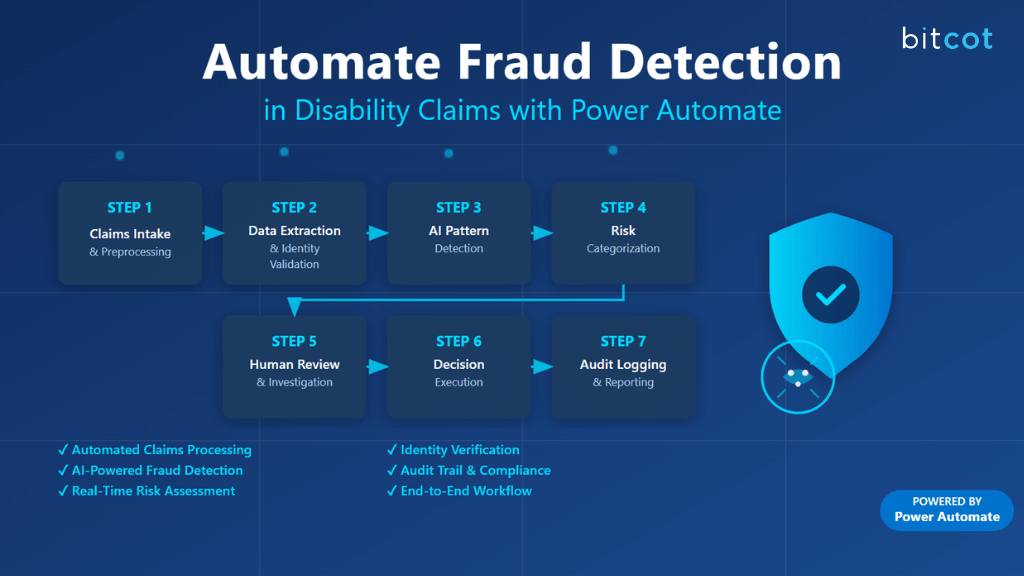

How to Automate Fraud Detection in Disability Claims with Power Automate

Automating fraud detection in disability claims might sound complex, but with Microsoft Power Automate, it’s completely achievable.

The key is combining automation, AI, and human decision-making into one seamless workflow.

Below is a step-by-step breakdown of how this solution can be built, from intake to investigation and auditing.

Step 1: Claims Intake & Preprocessing

Every fraud detection process starts with getting the claims in. Disability claims can arrive through different intake channels: online portals, email submissions, or even uploaded PDF forms. Handling all of these manually can easily slow things down, but Power Automate can unify and simplify this process.

Power Automate Actions:

- When a new response is submitted: Automatically capture claims submitted through online forms or portals.

- When a new email arrives (V3): Intake and extract claims directly from incoming emails, including attachments.

- Get file content: Retrieve uploaded PDF or Word forms submitted by claimants.

Best Practice:

Assign a unique Claim ID as soon as each claim enters the system. This ID becomes the claim’s digital fingerprint, ensuring that every step, from intake to final decision, can be tracked and audited easily across systems.

Step 2: Data Extraction & Identity Validation

Once claims are captured, the next step is to extract and validate key information: things like claimant details, identification numbers, and medical records. Instead of manually reading through each document, Power Automate can leverage AI Builder to pull structured data automatically.

Power Automate Actions:

- Extract information from documents: Use AI Builder Form Processing to extract key fields like name, ID number, and claim type from claim forms.

- Get items: Retrieve claimant history from SharePoint or Dataverse, allowing you to cross-check for duplicate or prior claims.

- HTTP: Connect to external government ID verification APIs to confirm that the claimant’s identity and details are valid.

- Condition: Flag any claims where ID data is missing or mismatched, automatically routing them for review.

This ensures that false identities or tampered information are caught early in the process, long before any payments are made.

Step 3: Fraud Pattern Detection via AI

Now comes the intelligence layer: identifying fraud patterns that might not be obvious to the human eye. Power Automate, integrated with AI Builder, can detect complex fraud signals in real time.

Common fraud patterns include:

- Duplicate claims filed under different identities.

- Unusual claim frequency from the same IP address or device.

- Medical certificates submitted from unverified or suspicious providers.

Power Automate Actions:

- Predict: Use the AI Builder Fraud Detection model to analyze claims and predict fraud likelihood.

- Filter array: Automatically search for duplicate or overlapping claims in your dataset.

- Compose: Store key suspicious attributes for each claim to build a fraud risk profile.

By automating this step, potential fraud can be flagged within minutes instead of weeks — dramatically improving detection speed and accuracy.

Step 4: Risk Categorization

Not every flagged claim is fraudulent. Some might just need a second look. Power Automate helps by categorizing claims based on risk severity, so teams can focus their efforts where it matters most.

Risk categories might look like this:

- Low Risk: No anomalies detected; ready for approval.

- Medium Risk: Minor inconsistencies; requires monitoring or follow-up.

- High Risk: Clear fraud indicators; escalate immediately.

Power Automate Actions:

- Switch: Branch workflows automatically based on the risk category.

- Append to array variable: Record categorized outcomes for tracking and reporting.

This ensures that high-risk claims get priority while legitimate claims continue moving forward without unnecessary delay.

Step 5: Human Review & Investigation

Automation is powerful, but it doesn’t replace human judgment. Once Power Automate identifies and categorizes suspicious claims, high-risk or complex cases are escalated to human investigators for deeper review.

Power Automate Actions:

- Start and wait for an approval: Automatically assign the claim to a fraud investigator for manual assessment.

- Post adaptive card and wait for a response: Send investigation details directly to the team in Microsoft Teams, allowing reviewers to approve, reject, or comment without leaving their workspace.

- Update item: Record the investigator’s final decision in SharePoint or Dataverse for transparency and traceability.

This step ensures the perfect balance between machine efficiency and human expertise.

Step 6: Decision Execution (Approve / Reject / Suspend)

Once both automation and human review are complete, it’s time to take action. Power Automate ensures that every decision, whether it’s approval, rejection, or suspension, is carried out consistently and communicated clearly.

Power Automate Actions:

- Condition: Route the outcome based on the decision logic.

- Send an email (V2): Notify claimants of the result, including the reason for rejection or any additional documentation needed.

- HTTP: Update the benefits management system with the final claim status to maintain synchronization across platforms.

This step closes the loop, ensuring every claim ends with a clear, auditable outcome.

Step 7: Audit Logging & Reporting

The final step is about accountability. Every action, from intake to decision, needs to be traceable. Power Automate automatically builds a full audit trail, ensuring compliance and enabling better fraud analytics.

Power Automate Actions:

- Add a row into a table: Log claim outcomes and metadata in Excel or Dataverse for record-keeping.

- Convert Word Document to PDF: Archive completed investigation reports securely.

- Refresh a dataset: Update Power BI dashboards with the latest fraud statistics, giving leadership a real-time view of trends and performance.

With this structure, compliance teams have everything they need for audits or reporting, without chasing spreadsheets or paper files.

Benefits of Automating Fraud Detection in Disability Claims

Automating fraud detection isn’t just about keeping up with technology: it’s about transforming how disability claims are processed.

With Power Automate, agencies can move from a reactive, paper-heavy process to a proactive, data-driven one that spots issues before they become costly mistakes.

Here’s how automation makes a real difference:

1. Faster Fraud Detection

Speed matters when it comes to fraud. Traditional reviews can take days or even weeks, giving fraudulent claims time to slip through and payments to go out before red flags are noticed. With automation, potential fraud is detected within minutes of submission.

Power Automate’s real-time monitoring and AI-driven workflows mean suspicious claims are automatically flagged the moment anomalies appear, allowing investigators to step in early and prevent wrongful payouts before they happen.

2. Higher Accuracy

Even the most skilled claims officers can miss details when faced with hundreds of files a week. Automation brings consistency and precision to the table. AI models analyze data patterns across thousands of claims simultaneously, spotting inconsistencies, duplicate submissions, or suspicious medical documentation that a human might overlook.

This results in fewer false positives (legitimate claims wrongly flagged as fraud) and a higher success rate in catching actual fraudulent activity.

3. Lower Operational Costs

Fraudulent claims don’t just drain resources; they cost agencies real money. Every fake payout represents funds that could have supported someone in genuine need. By automating fraud detection, organizations can reduce financial losses from false claims while also cutting down on manual labor costs.

Power Automate handles repetitive data checks and pattern matching, freeing up staff to focus on high-value tasks like investigations and claimant support. The result? A leaner, more cost-efficient fraud management process.

4. Regulatory Compliance and Transparency

Fraud detection isn’t just about catching bad actors; it’s also about proving you did things the right way. Power Automate ensures every action, decision, and escalation is logged automatically, creating a complete digital audit trail.

When auditors or regulators come knocking, teams can easily pull detailed records showing when a claim was flagged, who reviewed it, and what decision was made. This level of transparency not only simplifies compliance but also builds trust and accountability across the organization.

5. Scalability Without Added Headcount

As claim volumes grow, manual review processes quickly become unsustainable. Hiring more people to keep up isn’t always feasible or cost-effective. With Power Automate, agencies can scale operations effortlessly without needing to expand their teams.

The system can process thousands of claims in parallel, apply the same set of fraud detection rules consistently, and escalate only the truly suspicious cases for human review. This means your fraud detection capability grows without increasing your overhead.

Future Enhancements of Fraud Detection Automation in Disability Claims

While today’s automation solutions already bring speed and intelligence to fraud detection, the future holds even more powerful possibilities.

As technology continues to evolve, disability claims processing can become smarter, more secure, and even more proactive.

Here’s what’s on the horizon for the next generation of fraud detection automation:

1. Integration with Biometric Verification Systems

Imagine a world where fraudulent identities are caught before a single document is even processed. That’s where biometric verification comes in. By integrating Power Automate workflows with facial recognition or fingerprint scanning systems, agencies can instantly verify a claimant’s identity at the very start of the process.

This enhancement would prevent identity theft and duplicate claims filed under different names: one of the most common forms of fraud in disability claims. It also strengthens trust and ensures that benefits are delivered only to genuine, verified individuals.

2. Predictive Analytics for Emerging Fraud Trends

Fraud tactics evolve constantly; what worked last year might not work tomorrow. Future automation systems will incorporate predictive analytics, using machine learning models that continuously learn from new data and behavior patterns.

By analyzing trends in real time, these models can forecast emerging fraud schemes before they become widespread. For example, if an unusual spike in claims from a particular region or medical provider is detected, the system could automatically flag it for investigation. This shift from reactive detection to predictive prevention will be a game-changer for agencies trying to stay ahead.

3. Automated Collaboration with Law Enforcement

Catching fraud is only part of the battle: prosecuting it effectively is the next step. In the future, Power Automate could help streamline this by automating collaboration with law enforcement agencies.

When a confirmed fraudulent case is detected, the system could automatically compile all relevant documentation, such as claim details, investigation notes, timestamps, and evidence, and securely share it with legal authorities. This would reduce the time and effort spent coordinating between departments and ensure that strong, complete evidence packages are sent to prosecutors.

4. Continuous Monitoring of Previously Approved Claims

Fraud doesn’t always happen at the beginning of a claim. Sometimes, false information or misuse surfaces after approval. Future enhancements will include continuous monitoring of previously approved claims to detect suspicious post-approval activities, such as recurring medical visits, altered documentation, or changes in claimant data.

With ongoing monitoring in place, Power Automate can flag anomalies even months after a claim has been processed, allowing agencies to take corrective action quickly. This ensures long-term fraud prevention and helps maintain program integrity over time.

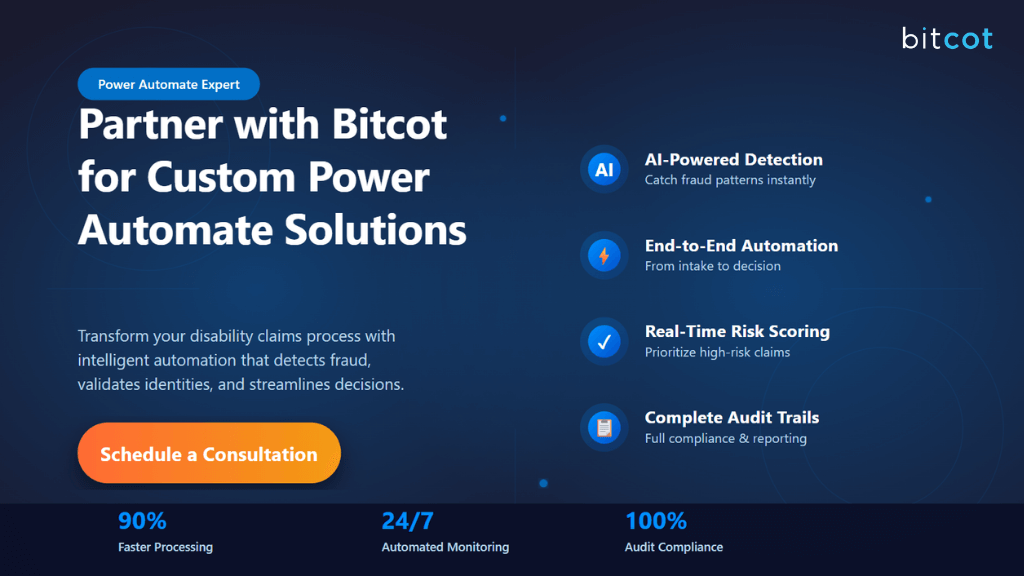

Partner with Bitcot to Automate Fraud Detection in Disability Claims

When it comes to automating fraud detection, choosing the right technology partner makes all the difference.

You need more than just technical know-how; you need a team that understands your challenges, your compliance landscape, and your mission to protect genuine claimants.

That’s where Bitcot stands out.

Here’s why organizations trust Bitcot to bring their Power Automate vision to life:

- Deep Expertise in Power Platform & AI: Bitcot’s certified Power Platform specialists combine deep knowledge of Power Automate, AI Builder, and Power BI to design intelligent workflows that catch fraud early, without disrupting your existing operations.

- Experience with Public Sector & Claims Processing: We understand the complex world of social programs, compliance rules, and audit requirements. Bitcot has worked with government agencies and large enterprises to streamline claims management and reduce fraudulent activity with measurable results.

- Custom-Built Solutions, Not One-Size-Fits-All: No two agencies or claims systems are alike. Bitcot develops tailored automation workflows that align perfectly with your data sources, approval processes, and compliance needs. You get a solution that fits, not one you have to adapt to.

- Seamless Integration Across Systems: Whether you’re using SharePoint, Dataverse, Dynamics 365, or third-party case management tools, Bitcot ensures secure, reliable integrations so your data flows smoothly and securely across platforms.

- Scalable, Future-Ready Design: Fraud schemes evolve, and your detection system should too. Bitcot builds scalable, future-proof architectures that can easily adapt to new fraud models, data sources, and regulatory changes without starting from scratch.

- Trusted Long-Term Partner: We don’t just deploy and disappear. Bitcot provides ongoing optimization, monitoring, and support to ensure your fraud detection system stays effective and aligned with your evolving business needs.

Partnering with Bitcot means you’re not just automating processes; you’re building a smarter, safer, and more accountable fraud detection ecosystem. With our expertise, innovation, and commitment to impact, Bitcot helps you stay ahead of fraud while ensuring every genuine claimant gets the benefits they deserve.

Final Thoughts

Fraud detection in disability claims doesn’t have to be a slow, reactive, and resource-heavy process anymore.

With the right automation strategy, agencies can move from constantly playing catch-up to staying one step ahead, identifying risks early, improving accuracy, and ensuring that benefits go to the people who truly need them.

Power Automate brings the technology to make that possible, combining AI, automation, and smart workflows that can think and act faster than traditional systems ever could. But technology alone isn’t enough. You need a partner who understands how to connect the dots, someone who knows how to make automation work for you, not just around you.

That’s exactly where Bitcot comes in. Whether you’re just starting your automation journey or looking to expand your fraud detection capabilities, Bitcot’s workflow automation services can help you design, build, and scale a Power Automate solution that fits your processes perfectly.

So if you’re ready to modernize how you detect and prevent fraud, and build a smarter, more efficient claims process, it’s time to partner with Bitcot. Let’s build your next intelligent automation solution together.

Get in touch with our team.