Let’s face it; keeping up with compliance is no joke for financial institutions these days. Regulators are tightening the screws, and organizations need to know fast if any client is linked to fraud, money laundering, or other risky activities.

That’s where adverse media screening, also called negative news screening, comes in.

It’s a key part of AML (Anti-Money Laundering) and KYC (Know Your Customer) processes, helping banks catch potential issues before they snowball.

Traditionally, this meant hours of manual searching through news sites, databases, and watchlists. Not exactly fun, and let’s be honest, it’s easy to miss something important. That’s why automation is a game-changer.

With Power Automate, you can set up workflows that continuously scan news, match it against customer records, flag high-risk cases, and even alert your compliance team automatically. Less manual grunt work, fewer blind spots, and faster decisions.

In this blog, we’ll break down how to automate adverse media screening with Power Automate, step by step, so your team can stay on top of risks without drowning in spreadsheets and alerts.

Challenges in Traditional Adverse Media Screening

Adverse media screening is a cornerstone of modern compliance, helping financial institutions identify clients involved in fraud, money laundering, or other high-risk activities.

Adverse media screening is a cornerstone of modern compliance, helping financial institutions identify clients involved in fraud, money laundering, or other high-risk activities.

Yet, despite its critical importance, traditional approaches are riddled with challenges that make the process slow, inconsistent, and resource-heavy.

Let’s take a closer look at the key hurdles organizations face:

1. Manual Searches Are Time-Consuming and Labor-Intensive

In a conventional setup, compliance teams manually scour public news websites, regulatory announcements, press releases, blogs, and specialized databases to identify potential risks. This involves reading through countless articles, extracting relevant information, and cross-referencing it against client records.

Not only does this take hours or even days, but it also places a heavy burden on human resources. When teams are stretched thin, even minor oversights can lead to major compliance gaps.

2. Inconsistent Detection Due to Varied Sources and Formats

News and media content appear in a variety of formats: structured databases, PDFs, blogs, RSS feeds, or social media posts. Relying on manual methods makes it extremely difficult to detect negative news consistently. A single critical article buried in an obscure source could easily be missed.

Additionally, the lack of standardization across sources means that even when news is found, extracting actionable insights is often inconsistent, leading to gaps in the institution’s risk monitoring.

3. Delayed Insights Resulting in Compliance Gaps

Speed is crucial in compliance. A delay in identifying a client linked to high-risk activities could expose an institution to reputational damage, regulatory penalties, or even financial loss. Traditional processes often lag because human review is sequential and slow.

By the time a news item is spotted, verified, and escalated, the information might already be outdated or acted upon too late. This delay compromises the proactive nature of risk management.

4. Resource-Intensive Processes with High Operational Costs

Manual adverse media screening is not just time-consuming; it’s expensive. Large compliance teams are required to continuously monitor multiple sources, analyze articles, and make judgment calls on potential risks.

This not only drives up labor costs but also limits scalability. As the volume of news and regulatory requirements grows, organizations may struggle to keep up without dramatically increasing headcount, which is neither cost-effective nor sustainable.

How Power Automate Transforms Adverse Media Screening

Adverse media screening is critical for keeping financial institutions compliant, but traditional approaches are slow, inconsistent, and resource-intensive.

Adverse media screening is critical for keeping financial institutions compliant, but traditional approaches are slow, inconsistent, and resource-intensive.

Enter Power Automate, a platform that brings workflow automation, AI capabilities, and seamless integration to the table.

By orchestrating the entire screening process, Power Automate transforms a cumbersome, manual operation into an efficient, reliable, and auditable workflow.

Here’s a closer look at how it works:

1. Continuous Monitoring Across Multiple Sources

One of the biggest challenges in traditional screening is staying on top of an ever-expanding universe of news and media sources. With Power Automate, the system can be configured to continuously monitor:

- News websites, blogs, and RSS feeds

- Press releases and industry publications

- Regulatory announcements and watchlists

- Social media or specialized databases

This continuous scanning ensures that your team receives alerts in near real-time whenever relevant negative news surfaces. No more manually checking multiple sources or risking missed alerts; the automation acts as your 24/7 compliance radar.

Business Benefit: Compliance teams gain proactive insights and can respond to potential risks immediately rather than reacting after the fact.

2. Automatic Correlation with Customer Data

Finding a negative news article is only the first step; linking it to the right client is crucial. Power Automate can automatically match news content against your customer records stored in CRM systems, Dataverse, or other databases.

Key features include:

- Fuzzy Matching: Accounts for name variations (e.g., “Jonathan Smith” vs. “J. Smith”)

- Entity Extraction: Identifies company names, individuals, or financial entities in the news

- Automated Flagging: Highlights articles that potentially involve your clients for further review

This automation eliminates the repetitive and error-prone task of manual cross-checking, ensuring that no client-related risk goes unnoticed.

Business Benefit: Higher accuracy in identifying relevant risks with significantly reduced manual effort.

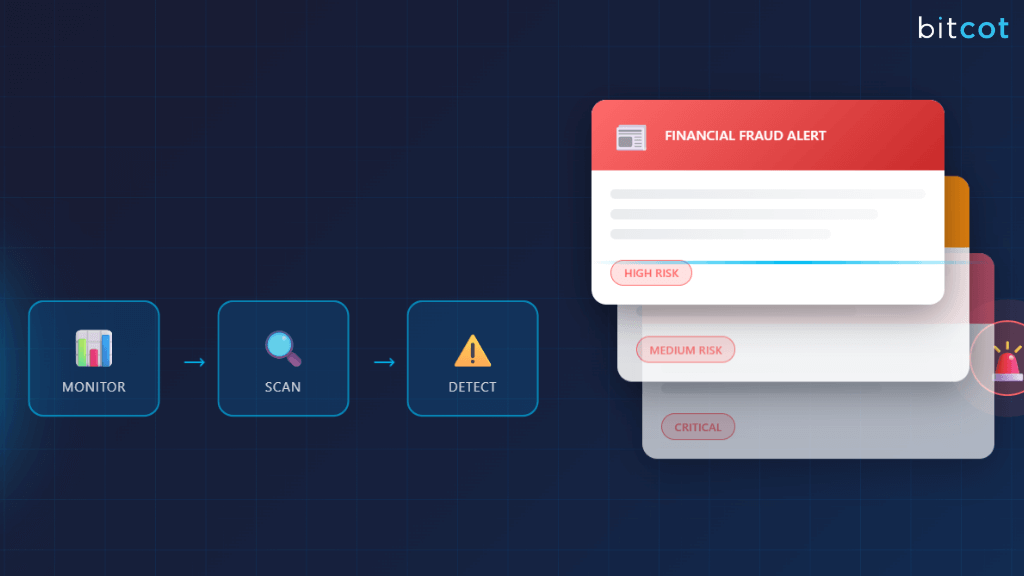

3. Intelligent Risk Categorization

Not all negative news carries the same weight. Power Automate can classify findings into low, medium, and high-risk categories as per preset rules:

- Low Risk: Minor reputational concerns, no regulatory implications

- Medium Risk: News related to ongoing investigations, lawsuits, or potential sanctions

- High Risk: Confirmed criminal associations, regulatory violations, or serious fraud

Automation can also assign risk scores using AI-powered sentiment analysis and context extraction. By triaging cases automatically, compliance teams can prioritize high-risk items and avoid wasting time on low-impact news.

Business Benefit: Ensures focus on the most critical threats, improving decision-making, and reducing oversight risk.

4. Escalation and Human Review

Automation works best when paired with human expertise. Power Automate can seamlessly escalate high-risk or ambiguous cases to compliance officers using:

- Teams Adaptive Cards or Approval Workflows: Present news articles, customer information, and AI-analyzed insights directly to reviewers

- Email Alerts: Notify compliance managers of urgent cases for immediate attention

- Integration with Case Management Systems: Automatically log reviewer actions and decisions

This “human-in-the-loop” approach ensures that sensitive decisions still benefit from human judgment, while automation handles repetitive tasks.

Business Benefit: Faster, smarter, and more consistent case handling without overwhelming compliance teams.

5. Full Audit Trail and Compliance Reporting

Regulatory compliance requires a clear, auditable record of all screening activities. Power Automate maintains a complete trail of:

- News detection and source details

- Customer matches and risk categorization

- Escalations and reviewer decisions

- Final resolutions and case closures

This data can be automatically stored in SharePoint, Dataverse, Excel, or PDF reports and integrated into Power BI dashboards for real-time visibility and KPI tracking. Auditors and regulators get a clear view of your institution’s compliance processes without additional manual work.

Business Benefit: Creates transparency, supports regulatory audits, and ensures accountability across all stages of adverse media screening.

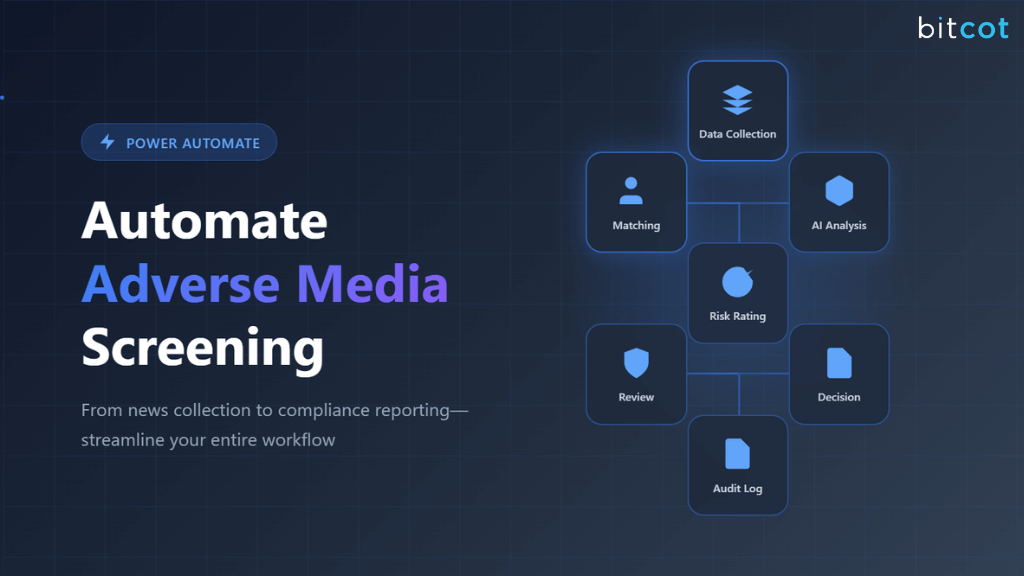

How to Automate Adverse Media Screening with Power Automate

Automating adverse media screening with Power Automate turns a time-consuming, manual process into a structured, efficient workflow.

Automating adverse media screening with Power Automate turns a time-consuming, manual process into a structured, efficient workflow.

Here’s a step-by-step guide to setting up a complete automation pipeline, from news collection to final reporting:

Step 1: Trigger & News Data Collection

The first step is to automatically gather news articles from multiple sources. Power Automate makes it easy to schedule recurring data collection so your compliance team is always working with the latest information.

How It Works:

- Recurrence: Schedule the workflow to run daily, weekly, or at a custom interval.

- HTTP Requests: Pull articles from news APIs like Bing News Search API, Google News API, or other public sources.

- Parse JSON: Structure incoming articles with key details such as title, content, publication date, and source.

- Create Item: Store the structured articles in SharePoint or Dataverse for further processing.

This automated collection ensures that no relevant news slips through the cracks and eliminates the need for manual monitoring.

Step 2: Customer Data Matching

Next, match the collected news against your organization’s customer records. This step identifies which articles are potentially relevant to clients.

Power Automate Actions:

- Get Items: Retrieve customer records from Dataverse or your CRM system.

- Filter Array: Compare customer names against the content of news articles.

- Condition: Flag articles that contain potential matches.

Best Practice: Use fuzzy matching logic to account for variations in names, initials, or formatting (e.g., “John A. Smith” vs “J. Smith”). This improves accuracy and reduces false negatives.

Step 3: AI-Powered Sentiment & Context Analysis

Not every news mention is negative or relevant. AI can help determine the sentiment and context of each article.

Power Automate Actions:

- Predict: Use AI Builder’s Sentiment Analysis to identify negative or high-risk content.

- Compose: Extract key entities such as crime types, financial terms, or regulatory keywords.

- Condition: Only mark articles that are negative and contextually relevant for further review.

This ensures that compliance officers focus only on genuinely high-risk information rather than wading through irrelevant news.

Step 4: Risk Categorization

Once the news is filtered, classify each finding based on severity.

Power Automate Actions:

- Switch: Define rules for categorization:

- Low: Minor reputational risk

- Medium: Ongoing investigations or legal cases

- High: Confirmed criminal association

- Append to Array Variable: Keep a log of categorized findings for downstream reporting.

Risk categorization helps prioritize the compliance team’s efforts and ensures that high-priority cases are escalated immediately.

Step 5: Escalation for Human Review

Automation handles the repetitive tasks, but human expertise is still needed for ambiguous or high-risk cases.

Power Automate Actions:

- Start and Wait for an Approval: Assign the case to a compliance reviewer.

- Post Adaptive Card in Teams: Present the article along with customer details for quick review.

- Update Item: Record the reviewer’s decision, whether to clear, flag, or escalate.

This step ensures human judgment is applied only where necessary, saving time while maintaining accuracy.

Step 6: Final Decision & Case Closure

After review, each case is finalized and appropriately documented.

Power Automate Actions:

- Condition: Route cases based on the reviewer’s decision.

- Send Email (V2): Notify relevant managers or compliance officers.

- Update Row: Close the case in the compliance database for recordkeeping.

This step ensures timely resolution and keeps all stakeholders informed.

Step 7: Audit Logging & Compliance Reporting

A complete audit trail is critical for regulators and internal oversight.

Power Automate Actions:

- Add a Row to a Table: Store outcomes in Excel, Dataverse, or SharePoint.

- Convert Word Document to PDF: Archive investigation reports for compliance purposes.

- Refresh Dataset: Update Power BI dashboards with compliance KPIs for real-time visibility.

Automating audit logging ensures full transparency, simplifies reporting, and provides regulators with easy access to all required information.

Benefits of Automating Adverse Media Screening with Power Automate

Financial institutions operate in an environment where timely and accurate information is critical.

Financial institutions operate in an environment where timely and accurate information is critical.

Automating adverse media screening with Power Automate delivers transformative benefits across risk management, compliance, efficiency, and scalability.

Let’s explore each advantage in detail:

Proactive Risk Management: Detect Reputational Risks Early

One of the greatest challenges in compliance is reacting too late. Traditional methods may detect negative news only after reputational damage or regulatory exposure has occurred.

With Power Automate, monitoring is continuous and automated. The system scans multiple news sources, APIs, and feeds in real-time, instantly identifying articles related to clients or counterparties. Early detection allows compliance teams to investigate potential issues before they escalate into serious financial, legal, or reputational consequences.

Example: If a client is implicated in a minor fraud case reported in a niche publication, the automated system flags it immediately, rather than waiting for manual review or internal reporting cycles. This proactive approach enables timely intervention and risk mitigation.

Regulatory Compliance: Ensure AML and KYC Requirements Are Met

Adverse media screening is a critical component of AML (Anti-Money Laundering) and KYC (Know Your Customer) compliance frameworks. Failure to monitor effectively can result in regulatory fines, sanctions, and reputational damage.

Power Automate ensures that all workflow steps are documented, auditable, and repeatable:

- News collection, filtering, and matching are logged automatically

- Risk categorizations and escalations are tracked with timestamps

- Final case resolutions are stored for reporting and regulatory audits

Example: During an audit, compliance officers can quickly demonstrate that every high-risk client news item was reviewed, categorized, and escalated appropriately, meeting regulatory expectations for due diligence.

Efficiency: Reduce Manual Searching and Review

Manual screening is labor-intensive and slow. Compliance teams often spend hours reviewing news feeds, extracting relevant content, and matching it with client databases. This repetitive work not only consumes resources but also leaves little room for focusing on high-value analysis.

Power Automate streamlines the process:

- Collects and structures news automatically

- Matches articles to customer records using intelligent logic

- Filters only relevant items for human review

By automating these tasks, teams can save hundreds of hours per month, reduce backlog, and focus on complex cases that require judgment rather than routine verification.

Example: Instead of sifting through hundreds of articles, a compliance officer only reviews a curated list of flagged items, dramatically increasing productivity.

Accuracy: AI-Driven Sentiment and Context Analysis Improves Detection

Not all mentions of a client in the media are negative or relevant to compliance. Manual screening is prone to errors; subtle context or tone may be missed, and false positives or negatives can occur.

Power Automate integrates with AI Builder to:

- Analyze article sentiment (positive, neutral, negative)

- Extract relevant entities such as crime types, financial keywords, or sanction references

- Identify context-specific relevance to compliance criteria

This AI-driven approach reduces human error, ensures that only relevant articles are escalated, and improves the overall quality of risk detection.

Example: An article mentioning a client in a neutral context, such as a charitable donation, would not trigger an unnecessary alert, while a high-risk criminal association is flagged immediately.

Scalability: Handle High Volumes of News Without Increasing Headcount

As institutions grow, the volume of news and potential risks grows exponentially. Traditional manual processes require proportionally larger compliance teams, which is costly and difficult to manage.

Power Automate workflows are inherently scalable:

- Capable of processing thousands of news articles daily

- Handles multiple APIs, RSS feeds, and data sources simultaneously

- Automatically categorizes and routes items for review without adding more staff

Example: A bank with thousands of clients worldwide can monitor global news in real-time without hiring additional compliance officers, ensuring consistent coverage across all regions and reducing operational overhead.

Future Enhancements in Adverse Media Screening Automation

While Power Automate already transforms adverse media screening into a fast, accurate, and auditable workflow, the potential for further innovation is enormous.

While Power Automate already transforms adverse media screening into a fast, accurate, and auditable workflow, the potential for further innovation is enormous.

As financial institutions face growing regulatory demands and increasingly complex risk landscapes, several enhancements can take automated screening to the next level:

1. Integration with Global Watchlists and Sanctions Data

Currently, automated workflows can monitor news sources for client-related risks. The next step is integrating global watchlists, sanctions lists, and regulatory databases directly into the screening process.

By combining adverse media monitoring with official sanctions and watchlist data, institutions can:

- Detect potential connections to sanctioned individuals or organizations

- Ensure compliance with international AML and anti-terrorism regulations

- Minimize manual cross-referencing between multiple databases

Benefit: Creates a single, comprehensive view of client risk, improving both accuracy and regulatory compliance.

2. Real-Time Alerting for Critical News

Today’s workflows often run on scheduled intervals, daily or weekly. Future enhancements could enable real-time alerts for breaking news, ensuring compliance teams are notified the moment a critical risk emerges.

How it works:

- Trigger workflows immediately when a high-risk article or news item appears

- Push notifications via email, Teams, or mobile apps

- Allow instant review and escalation for urgent matters

Benefit: Compliance officers can respond proactively, rather than reacting to risks after the fact, dramatically reducing potential exposure.

3. Natural Language Summarization for Concise Case Reports

Adverse media articles can be lengthy, with critical information buried within paragraphs of content. Future automation could leverage natural language processing (NLP) to summarize articles into concise, actionable insights.

How it works:

- Extract key points: client name, type of risk, date, and source

- Generate short, readable summaries for compliance officers

- Include risk scoring and relevant context automatically

Benefit: Reduces cognitive load on reviewers, allowing them to process more cases faster without missing important details.

4. Machine Learning Models for Refined Relevance Scoring

Not all flagged articles are equally relevant to compliance. Machine learning (ML) can help improve risk prioritization by learning from past decisions.

How it works:

- ML models analyze historical screening data, reviewer decisions, and outcomes

- Automatically adjust scoring algorithms to better predict which articles are high-risk

- Continuously improve over time as more data is processed

Benefit: Compliance teams spend less time on false positives and focus on the most critical risks, improving both efficiency and accuracy.

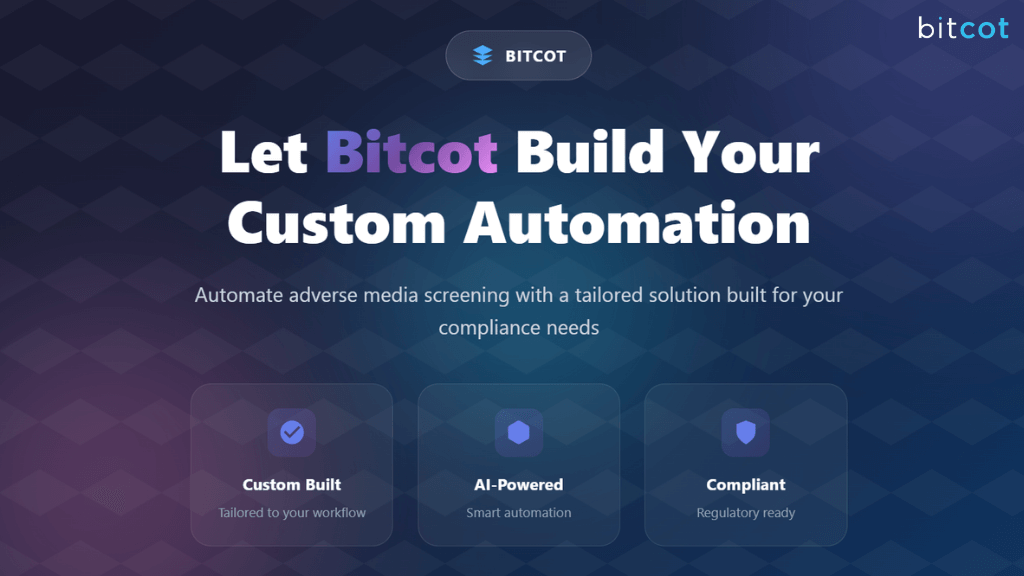

Partner with Bitcot to Automate Adverse Media Screening with a Custom Solution

Automating adverse media screening is no longer optional; it’s essential for financial institutions aiming to stay ahead of compliance risks.

Automating adverse media screening is no longer optional; it’s essential for financial institutions aiming to stay ahead of compliance risks.

Partnering with Bitcot allows you to implement a custom Power Automate solution designed specifically for your organization’s needs.

Here’s how we can help:

- Custom Workflow Design: We analyze your existing compliance processes and design a Power Automate workflow that aligns with your organization’s risk management and reporting requirements. Every step, from news collection to case closure, is tailored to your operational needs.

- Integration with Your Systems: Whether your customer data resides in Dataverse, CRM platforms, or other databases, Bitcot ensures seamless integration. Automated matching of news articles to client records becomes fast, accurate, and fully auditable.

- AI and Machine Learning Implementation: We leverage AI for sentiment analysis, entity extraction, and context evaluation. For advanced clients, we can integrate machine learning models to refine risk scoring and relevance, minimizing false positives and focusing attention on high-priority cases.

- Scalable and Flexible Solutions: Our solutions are designed to grow with your organization. Whether you handle hundreds or thousands of clients and news articles daily, the automated workflows scale without the need for additional manual resources.

- Future-Ready Enhancements: We plan for the future by incorporating features like real-time alerts, global watchlist integration, and natural language summarization to make adverse media screening smarter, faster, and more actionable.

- Ongoing Support and Optimization: Bitcot doesn’t just deploy the solution and leave. We provide continuous monitoring, optimization, and support to ensure your workflows evolve with changing regulations and risk landscapes.

Partnering with Bitcot empowers your compliance team to stay ahead of risks, reduce manual effort, and achieve regulatory confidence, all while leveraging the full capabilities of Power Automate for a tailored, future-proof fintech solution.

Final Thoughts

Adverse media screening is no longer a process you can afford to handle manually.

Adverse media screening is no longer a process you can afford to handle manually.

With the increasing complexity of financial crimes, regulatory scrutiny, and the sheer volume of news sources, traditional methods are slow, error-prone, and resource-intensive.

By leveraging Power Automate, institutions can transform their screening processes into a proactive, intelligent, and scalable workflow.

Automation enables continuous monitoring of multiple sources, AI-powered sentiment and context analysis, risk categorization, and seamless escalation for human review, all while maintaining a clear audit trail for regulatory compliance.

The benefits are clear: faster detection of reputational risks, improved compliance accuracy, reduced operational costs, and scalability that grows with your organization. And the future possibilities, like real-time alerts, integration with global watchlists, and machine learning–driven relevance scoring, promise to make automated adverse media screening even smarter and more efficient.

Partnering with experts like Bitcot ensures that your organization can implement a customized, end-to-end automation solution tailored to your unique compliance needs.

With our workflow automation services, your compliance team can focus on strategic decision-making rather than manual monitoring, ultimately protecting your institution from risk and maintaining regulatory confidence.

Get in touch with our team.