You write the check for $15,000. You board the plane. You spend four days shaking hands. Then you return home with 200 business cards and zero signed partnerships. This scenario plays out at healthcare conferences constantly.

The digital health environment in 2026 demands smarter conference choices, not just attendance. The stakes are higher now.

With AI transforming clinical workflows at unprecedented speed, interoperability challenges persisting across healthcare IT systems, and value-based care models reshaping reimbursement structures through population health management, healthcare leaders need strategic touchpoints that deliver ROI beyond networking.

Not inspiration. Results.

This guide cuts through the noise to identify the digital health conferences that deliver the highest strategic value for US-based founders, CTOs, product leaders, operations heads, and enterprise decision-makers.

While major January events like CES 2026 and the J.P. Morgan Healthcare Conference have already concluded with their typical blend of innovation showcases and investment discussions, the year ahead offers numerous strategic opportunities.

From curated executive forums to massive global exhibitions, each remaining conference serves distinct purposes. Understanding which events align with your specific business objectives determines whether conference budgets generate ROI or waste resources.

But which conferences actually matter? That depends on what you need to accomplish.

Before evaluating specific events, understanding the fundamental shifts reshaping the conference ecosystem helps frame strategic decisions.

Why Digital Health Conferences Matter More in 2026

The healthcare IT sector reached $329 billion globally in 2025 and is projected to grow to $386.58 billion in 2026, accelerating at a 17.5% CAGR through 2035. But attending conferences without strategy wastes both time and budget.

The Investment Landscape Has Shifted

Healthcare executives face a transformed investment environment. The US IPO market saw 176 healthcare and technology IPOs raise over $30 billion in the first nine months of 2025, marking a 20% increase from 2024.

Private capital remains concentrated in mega rounds led by institutional investors, while secondary transaction volumes are projected to exceed $210 billion in 2025. This concentration makes conference networking even more critical for founders seeking funding for healthcare technology solutions and digital therapeutics.

The old rules no longer apply. Traditional equity paths no longer guarantee success.

Pharmaceutical companies now prioritize bolt-on acquisitions and staged partnerships over early equity investments. Understanding these dynamics through direct conversations at major conferences gives leadership teams the intelligence needed to structure deals properly.

Miss these conversations? Fall behind competitors who attend.

Technology Integration Accelerates Daily

Healthcare systems deploy new AI tools, interoperability frameworks, and patient engagement platforms continuously for precision medicine and clinical decision support. What conferences help me stay updated on healthcare technology trends?

The short answer: events that combine technical depth with business strategy, not surface-level vendor showcases. The deeper answer requires understanding what “staying updated” actually means in practice.

Quantum computing applications in drug discovery, agentic AI systems with closed-loop responses, and ambient clinical intelligence solutions dominate 2026 discussions. Executives who miss these conversations about healthcare AI agents and machine learning algorithms fall behind competitors quickly.

Regulatory Complexity Demands Informed Leadership

Digital health solutions navigate FDA oversight, HIPAA compliance, state-level privacy regulations, and international data protection standards simultaneously. Conference sessions featuring policymakers, legal experts, and compliance officers provide the nuanced understanding leadership teams need to avoid costly mistakes.

With this context in mind, let’s examine which conferences deliver the most strategic value across different business objectives.

Essential Digital Health Conferences for 2026

Strategic conference selection separates thriving organizations from those burning budgets. Here are the must-attend events covering the full spectrum from value-based care policy to European innovation hubs to clinical specialization and hospital operations.

17th Annual Medicaid Innovations Forum

Dates: February 4-5, 2026

Location: St. Petersburg, Florida

The Medicaid Innovations Forum convenes program leaders, payers, and providers to address the complex challenges of serving 90+ million Medicaid beneficiaries across diverse state programs. This focused gathering delivers strategic insights into care delivery models, funding mechanisms, and digital health adoption within value-based care frameworks.

Why Medicaid matters for digital health: With Medicaid representing nearly 20% of US healthcare spending, organizations developing solutions for underserved populations must understand program dynamics, reimbursement structures, and state-level variations. The forum provides concentrated access to decision-makers who control billions in healthcare technology investments.

Key themes include health equity initiatives, social determinants of health integration, maternal and child health innovation, and managed care organization strategies. State Medicaid directors share implementation experiences, providing insights not available through other channels.

Strategic value: Direct conversations with payers and program administrators who approve digital health solutions for vulnerable populations. Understanding Medicaid reimbursement unlocks market access for telehealth, remote patient monitoring, and care coordination platforms.

The forum’s intimate setting facilitates substantive discussions that mega-conferences miss. Decision-makers attend specifically to solve problems, not just network.

With Medicaid’s policy framework established, the digital health marketplace shifts to Los Angeles for the year’s premier buyer-seller gathering.

ViVE 2026

Dates: February 22-25, 2026

Location: Los Angeles Convention Center, California

ViVE merges CHIME’s leadership strength with HLTH’s marketplace dynamics to create a premier digital health event focused on business transformation.

This conference targets C-suite executives, senior digital health leaders, and buyers. The curated matchmaking programs set ViVE apart. Here’s how.

Provider, Payer, and Pharma Connect brings decision-makers together with solution providers through 15-minute, double opt-in meetings. Participants completing eight meetings receive complimentary passes. This structure drives tangible outcomes rather than casual networking. No wandering exhibit halls. Structured conversations with pre-qualified buyers.

Investor Connect pairs leading investors with high-growth startups through targeted meetings that accelerate partnerships and funding discussions.

Key programming covers AI implementation, interoperability strategies, value-based care models, and digital therapeutics. Real-world case studies provide actionable frameworks for implementation.

Special programs include:

- AI Zone for technical discussions

- InteropNOW! focused on data exchange

- Startup Pavilion showcasing solutions

- Health Tech Showcase featuring products

Strategic value: ViVE’s four-day format allows teams to maximize participation without mega-conference overwhelm while accessing senior decision-makers across healthcare.

As ViVE focuses on the North American marketplace, Europe’s innovation hub convenes simultaneously to advance digital transformation across the continent.

health.tech Basel

Dates: March 3-5, 2026

Location: Basel, Switzerland

health.tech Basel brings together European health innovation leaders, policymakers, investors, and startups for strategic cross-sector dialogue at the heart of Europe’s life sciences corridor. This gathering emphasizes regulatory insight, reimbursement frameworks, and digital transformation unique to European healthcare systems.

Why attend a European conference? Organizations planning international expansion need firsthand understanding of European market dynamics. Healthcare systems across the EU, UK, and Switzerland operate under different regulatory frameworks, data protection standards, and reimbursement models than US markets.

The conference explores digital therapeutics regulation, real-world evidence requirements, AI governance under EU frameworks, and cross-border data exchange challenges. Sessions feature regulators from Swissmedic, EMA, and national health authorities who shape digital health policy.

Strategic networking opportunities: health.tech Basel attracts pharmaceutical leaders from Roche, Novartis, and other Basel-headquartered companies, creating unique partnership possibilities. The startup ecosystem showcases European innovations often overlooked by US-focused conferences.

Topics include decentralized clinical trials, patient-centric digital health, connected care delivery, and health data infrastructure. The European perspective on AI governance and data privacy provides valuable insights for global product strategy.

Market intelligence: Understanding European approaches to digital health adoption helps companies develop globally competitive solutions. Many European markets lead in areas like nationwide EHR adoption and integrated care delivery.

For organizations that need deeper technical understanding to complement European market insights, HIMSS provides the foundational knowledge just days later in Las Vegas.

HIMSS26 Global Health Conference

Dates: March 9-12, 2026

Location: Venetian Convention & Expo Center, Las Vegas, Nevada

HIMSS remains the backbone event for healthcare technology leaders globally. The 2025 conference welcomed over 25,000 healthcare pioneers from 88 countries, with 2026 expanding further.

What makes HIMSS different from other healthcare conferences? The depth of technical content combined with strategic frameworks for bridging innovation and execution. This isn’t superficial vendor promotion but substantive education on interoperability, governance, and infrastructure scaling.

Think less inspiration, more implementation. Less keynote theater, more technical workshops.

Over 600 educational sessions cover AI-powered diagnostics, care delivery models, cybersecurity, digital health maturity, and workforce challenges. The Interoperability Showcase demonstrates working solutions rather than just discussing concepts.

Exhibition scale: 950+ exhibitors showcase healthcare IT solutions across specialized zones. The format allows hands-on demonstrations and detailed technical discussions.

Preconference forums on March 9 provide full-day deep dives for teams wanting concentrated learning. Executive Summit programming runs concurrently for C-level participants.

For implementation teams: HIMSS delivers the technical depth needed to evaluate solutions, understand integration requirements, and plan deployment timelines. Product managers and CTOs gain insights that inform technology roadmaps.

Certificate opportunities: Attendees can pursue CPHIMS or CPDHTS certifications onsite, adding professional credentials while attending.

Where HIMSS provides broad healthcare IT infrastructure knowledge, specialized clinical conferences like ACC deliver deep domain expertise in specific therapeutic areas.

American College of Cardiology Conference 2026

Dates: March 28-30, 2026

Location: New Orleans, Louisiana

ACC 2026 spotlights the latest advancements in cardiovascular medicine, clinical trials, and digital health tools reshaping cardiology. With heart disease remaining the leading cause of death in the United States, cardiovascular health technologies represent a massive market opportunity.

But clinical validation matters here more than anywhere else.

Why digital health leaders should attend: Remote patient monitoring plays an increasingly central role in managing chronic cardiovascular conditions. Wearable cardiac monitors, AI-powered ECG analysis, and digital therapeutics dominate innovation discussions.

The conference brings together cardiologists, cardiac surgeons, and healthcare IT professionals. Presentations showcase clinical trial results that validate digital health interventions, providing evidence needed for reimbursement and hospital adoption.

Strategic value for technology companies: ACC provides direct access to physician decision-makers who influence medical device software development and technology purchases at medical centers nationwide. Understanding clinician perspectives on usability and workflow integration informs product development.

Where ACC focuses on clinical innovation in a specific specialty, Becker’s addresses the operational realities of running entire health systems.

Becker’s 16th Annual Meeting

Dates: April 13-16, 2026

Location: Hyatt Regency Chicago, Illinois

Becker’s Hospital Review Annual Meeting convenes 4,000+ hospital and health system executives for four days of focused discussion on operational excellence, margin recovery, workforce sustainability, and technology adoption. Over 795 speakers address pressing challenges.

Who attends Becker’s? CEOs, CFOs, CMIOs, CNOs, CIOs, and service line executives from hospitals and health systems nationwide. These decision-makers approve digital health investments and drive implementation strategies.

Core themes for 2026 include AI adoption, cybersecurity risk management, value-based care evolution, and workforce solutions. The format emphasizes practical strategies attendees can implement immediately.

Why this matters for digital health: Hospital executives attending Becker’s actively seek technology partners to solve real operational problems. Unlike conferences dominated by future innovation, Becker’s focuses on what works now and delivers ROI.

The difference matters. These executives don’t want vision. They want validated solutions with proven track records.

The networking opportunities connect solution providers with system leaders facing budget constraints and staffing shortages. Understanding these constraints helps companies position solutions addressing actual pain points.

Celebrity keynote speakers and high-profile executives create draw, but peer discussions in hallways often yield the most valuable insights into hospital technology decisions.

Building on the operational focus from Becker’s, DMEA provides another perspective on healthcare system challenges through Europe’s largest digital health gathering.

DMEA 2026

Dates: April 21-23, 2026

Location: Messe Berlin, Germany

DMEA represents Europe’s leading digital health event with over 900 exhibitors, 20,500+ visitors, and 470 high-caliber speakers. The conference demonstrates how European healthcare systems approach digital transformation differently than US markets.

Strategic value of European exposure: European healthcare often leads in areas like nationwide EHR systems, integrated care delivery, and data protection frameworks. Learning from these implementations provides templates applicable to US contexts while understanding international market requirements.

DMEA’s nova Award recognizes breakthrough innovations, giving startups visibility across European markets. The 2025 winner, PAICON, impressed with its mission to make cancer diagnostics equitable through data diversity and AI.

Topics span electronic health records, telemedicine platforms, AI diagnostics, medical device innovation, and data security. German healthcare’s emphasis on data protection makes DMEA valuable for compliance-focused teams.

For organizations with global ambitions: DMEA provides concentrated access to European decision-makers, regulatory insights, and partnership opportunities that complement North American market strategies.

From European digital health systems, the focus shifts to global population health research and innovation.

Digital Public Health Conference 2026

Dates: June 24-26, 2026 (June 23 pre-conference student day)

Location: Barcelona, Spain

The 11th International Digital Public Health Conference brings together researchers, innovators, and policymakers focused on population health technology applications. This interdisciplinary event emphasizes research and innovation rather than commercial promotion.

Who benefits most from DPH? Organizations developing solutions for underserved populations, public health departments, and research institutions find concentrated expertise here.

Unlike commercial conferences, DPH prioritizes evidence-based approaches and equity considerations. Sessions explore how digital tools address social determinants of health and improve population outcomes.

The academic community presence makes this ideal for organizations needing validation studies or access to emerging research before commercial translation.

As the year progresses from summer to fall, one final marquee event brings together the entire healthcare ecosystem for the industry’s most comprehensive gathering.

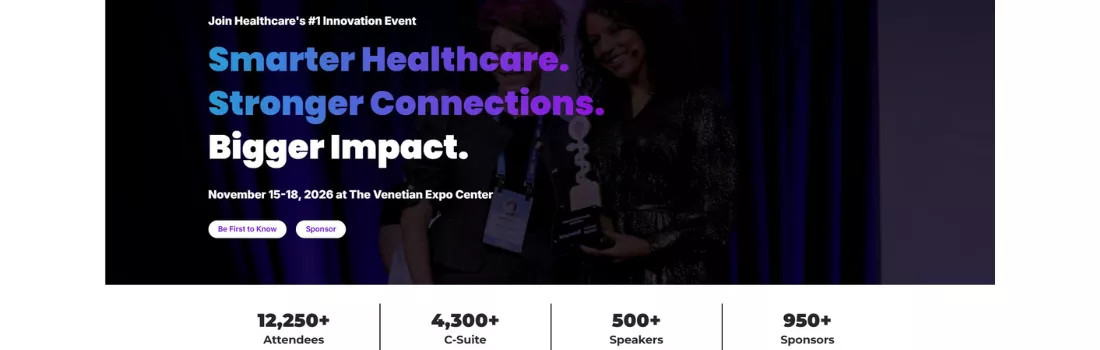

HLTH USA 2026

Dates: November 15-18, 2026

Location: Las Vegas, Nevada

HLTH has established itself as healthcare’s premier innovation conference, drawing an unmatched mix of executives, startups, payers, providers, life sciences leaders, investors, and policymakers annually.

What makes HLTH the must-attend fall conference? The ecosystem approach. HLTH deliberately brings together every healthcare stakeholder type to set the industry agenda. Programming balances big-stage keynotes with technical tracks, product showcases, and investor-startup matchmaking.

Focus areas include AI and emerging technology, diagnostics innovation, workforce health solutions, patient voice platforms, and pharma transformation.

The Market Connect Program offers structured meetings between solution providers and qualified buyers. Super Buyer status provides $750 travel credits for participants completing 12+ meetings, incentivizing serious business discussions.

Entertainment and culture: HLTH incorporates live performances into programming, creating a distinctive conference experience. The Welcome Reception at Topgolf Las Vegas and daily Happy Hours foster relationship building in relaxed settings.

Team participation: HLTH’s diverse programming makes it valuable for cross-functional teams. Product leaders, clinical teams, and business development staff all find relevant content and networking opportunities.

Beyond these anchor events that attract broad healthcare audiences, several specialized conferences serve specific strategic needs or market segments.

Additional Notable Conferences Worth Considering

Several other events deserve consideration based on specific organizational needs and strategic priorities.

Population Health and Value-Based Care

AHA Rural Health Care Leadership Conference (February 8-11, 2026, San Antonio, Texas) addresses the unique challenges rural health systems face including workforce shortages, limited technology budgets, and digital access barriers. For companies bringing remote patient monitoring and telehealth into rural areas, this conference connects strategy with practical implementation.

International Expansion Opportunities

HIMSS European Conference (May 19-21, 2026, Copenhagen, Denmark) convenes Europe’s digital health community for insights on digital transformation, AI strategy, and connected healthcare across the continent.

Digital Health London (May 26-27, 2026, London, UK) offers strong European perspectives on AI in MedTech, real-world data applications, and chronic care management with global speaker lineups.

HLTH Europe 2026 (June 15-18, 2026, Amsterdam, Netherlands) extends HLTH’s influential platform to European markets, bringing together the continent’s healthcare ecosystem for discussions on consumerization of care, omnichannel patient engagement, and European regulatory approaches to healthcare data privacy.

Arab Health/WHX Dubai (February 9-12, 2026, Dubai, UAE) represents the largest healthcare exhibition in the Middle East, providing access to rapidly growing markets across the Gulf region, North Africa, and South Asia. Digital health companies eyeing international expansion for healthcare mobile applications find concentrated opportunities here.

Specialized Focus Areas

Reuters Pharma USA provides cornerstone gathering for pharma, biotech, commercialization, market access, and patient strategy leaders with over two decades of industry leadership in drug development and market dynamics.

The MedTech Conference (October 18-21, 2026, Boston, Massachusetts) emphasizes medical device innovation, regulatory pathways for FDA approval, and commercialization strategies with strong focus on predictive analytics and AI-driven diagnostics for medical device software development.

These specialized conferences serve specific niches within digital health including life sciences software development, clinical trials management, and precision medicine. Organizations should select based on current business priorities, target markets, and strategic expansion plans rather than attempting to attend everything.

How to Choose the Right Conference for Your Organization

Conference selection requires strategic thinking beyond dates and locations. The wrong choice wastes resources.

So how do you decide? Start here.

Define Clear Objectives First

What specific outcomes do you need from conference attendance? Generic networking goals rarely justify expenses. Instead, define concrete objectives such as identifying three integration partners, meeting five investors, or understanding competitive positioning in emerging segments like healthcare AI automation.

ViVE delivers buyer-seller connections. HIMSS provides technical depth. HLTH offers ecosystem-wide visibility. health.tech Basel opens European markets. Medicaid Innovations Forum connects with payer decision-makers.

Match Conference Audiences to Your Needs

Product development teams benefit from HIMSS where solution architects, implementation specialists, and technology officers concentrate. Business development functions gain more from ViVE’s structured matchmaking or HLTH’s broad executive attendance.

Am I targeting payers, providers, or both? This question determines which conferences deliver the most qualified conversations for healthcare software development partnerships.

Understanding attendee demographics prevents pitching provider solutions to investor-heavy audiences or vice versa.

Startup founders seeking Series A or B funding prioritize conferences with strong investor presence like HLTH’s Investor Connect. Later-stage companies focused on enterprise sales choose buyer-rich environments like ViVE.

Consider Geographic and Timing Factors

West Coast conferences attract different audiences than Las Vegas events. International conferences require passport logistics and travel time but open global markets.

How does conference timing align with our business cycle? This alignment often makes the difference between breakthrough outcomes and wasted trips.

Attending conferences during product launches, funding rounds, or sales cycles multiplies impact. You have momentum, proof points, and urgent needs that make conversations productive.

Conference attendance during quiet periods yields minimal value because you lack compelling stories and immediate needs.

Early registration typically saves 20-30% on passes. Hotel blocks near venues fill quickly, often months in advance. Organizations booking late face premium pricing and inconvenient locations.

Evaluate Conference Track Records

First-time conferences carry higher risk than established events. Research previous years’ attendee reviews, speaker quality, and exhibitor satisfaction before committing budgets.

What ROI have similar companies achieved? Speaking with peers who attended previous years provides realistic expectations. Were attendee levels accurate? Did matchmaking programs deliver quality meetings? Was content substantive or superficial?

Conferences evolve. HLTH grew rapidly from startup to major event. ViVE emerged to address gaps other conferences missed. Understanding trajectory helps predict future value.

Calculate Total Investment Beyond Registration

Conference passes represent only part of total costs. Factor in travel, accommodation, meals, team time away from operations, and opportunity costs.

A $2,000 conference pass becomes a $6,000 investment after flights, hotels, and meals. Sending three team members triples that. Does the expected return justify this investment compared to alternatives?

Leverage Pre-Conference Preparation

Maximize conference value through advance preparation. Review attendee lists when available. Schedule meetings beforehand. Research exhibitors and speakers. Prepare discussion points for target conversations.

How do I get meetings with the right people before the conference? The answer lies in proactive outreach using conference tools most attendees ignore.

Most conferences offer attendee contact platforms, mobile apps, or networking tools. Proactive outreach 4-6 weeks before the event yields better meeting quality than hoping for chance encounters.

Send personalized connection requests referencing shared interests or business reasons for connecting. Generic mass invites get ignored. Thoughtful outreach gets responses.

Coordinate team coverage of different sessions and exhibit areas. Designate one person to track competitive intelligence, another to evaluate partners, and a third to focus on technology trends. Debrief daily to share learnings and adjust strategies.

Selecting the right conferences sets the foundation. Executing strategically determines actual outcomes.

Maximizing ROI from Conference Attendance

Attending conferences represents significant investment. These strategies ensure returns justify expenses.

Most attendees waste their time. Here’s how to avoid that trap.

Set Measurable Goals and Track Outcomes

What specific metrics define conference success? Establish quantifiable targets like meetings held with qualified prospects, partnership discussions initiated, investor conversations completed, or competitive intelligence gathered.

Create simple tracking mechanisms during the conference. Use shared spreadsheets or CRM systems to log conversations, capture contact information, and record follow-up commitments before details fade.

Compare actual outcomes against pre-defined goals within one week of returning. Did you achieve the five investor meetings targeted? Connect with three potential integration partners? Honest assessment reveals which conferences delivered value.

Prioritize Quality Conversations Over Quantity

The person who collects 200 business cards but has no meaningful conversations wastes their time. Period.

Better to have 15 substantive discussions that advance specific business objectives than superficial exchanges with hundreds of people.

How long should conference meetings last? The answer depends on conversation depth, but minimum thresholds matter.

Quality conversations require 15-30 minutes minimum to move beyond pleasantries into substance. Block calendar time for scheduled meetings and protect against over-committing.

Take detailed notes immediately after each significant conversation. What specific interests did the person express? What follow-up did you commit to? Memory fades quickly in conference environments.

Balance Structured and Spontaneous Networking

Scheduled meetings provide predictable value but spontaneous conversations often yield unexpected opportunities. Allocate time for both approaches rather than filling every minute with planned activities.

Exhibit halls, networking receptions, and coffee breaks create spaces for serendipitous connections. The person waiting in line for coffee might become your next strategic partner.

Deploy Team Members Strategically

Organizations sending multiple people should coordinate coverage rather than duplicating efforts. Assign each team member specific roles aligned with their expertise and objectives.

Your CTO attends technical sessions while your VP of Business Development works the exhibit floor. Your product manager evaluates competitive offerings while your CEO pursues investor conversations.

Should we all attend the same keynotes and sessions? In most cases, no. The exception matters though.

Divide and conquer approaches gather more intelligence than moving as a group. Exception: critical industry announcements warrant full team attendance to ensure aligned understanding.

Execute Disciplined Follow-Up

Conference value compounds through systematic follow-up. The majority of attendees never follow up, making those who do stand out dramatically.

When should I follow up after meeting someone at a conference? Within 48-72 hours while conversations remain fresh. Wait longer and you become just another forgotten face.

Personalized messages referencing specific discussion points work far better than generic emails. The difference between “Great meeting you at HIMSS” and “Following up on our conversation about implementing RPM for your CHF population” determines whether you get a response.

Create follow-up task lists before leaving the venue. Prioritize contacts by business value and time-sensitivity. Delegate tasks among team members based on relationship ownership.

Track follow-up completion rates and outcomes. Which connections converted to partnerships or investment discussions? This data informs future conference decisions.

Conference knowledge remains isolated in attendees’ heads unless deliberately shared. Schedule debrief sessions with broader teams to distribute insights, competitive intelligence, and market trends.

Create written summaries of key learnings, emerging technologies observed, competitor strategies detected, and partnership opportunities identified. Circulate these summaries to leadership teams, product groups, and relevant stakeholders.

How do I justify conference expenses to finance teams? Connect conference activities directly to business metrics they care about through EHR/EMR software development opportunities or AI integration partnerships.

Document concrete outcomes in business terms: partnerships initiated with projected revenue impact, product insights that improved roadmap decisions, competitive intelligence that shaped strategy, or investor relationships that advanced funding goals.

Abstract “networking value” doesn’t satisfy CFOs. Specific pipeline additions, deal accelerations, and strategic pivots do.

Armed with conference insights, partnership opportunities, and market intelligence, the next challenge becomes execution. Conferences reveal what’s possible. Implementation determines what’s profitable.

Turning Conference Insights into Working Digital Health Solutions

The conferences covered here reveal recurring themes in digital health innovation. AI integration, interoperability challenges, value-based care pressures, and patient engagement needs dominate every event. But inspiration without execution leads nowhere. The gap between conference promises and production systems is where most initiatives die.

Bitcot helps organizations translate the partnerships, insights, and technologies discovered at conferences into deployed solutions. From healthcare digital transformation consulting to AI-powered diagnostics, we turn vision into working platforms.

Bitcot bridges the gap between conference floor conversations and production-ready healthcare solutions. We help organizations translate the partnerships, insights, and technologies discovered at HIMSS, ViVE, HLTH, and industry events into deployed digital health platforms that improve patient outcomes and operational efficiency.

Our healthcare software development expertise spans telemedicine platforms, patient engagement applications, clinical decision support systems, data integration solutions, and AI-powered diagnostic tools. We understand HIPAA compliance, HL7 and FHIR interoperability standards, and mobile health application development for value-based care delivery.

What makes Bitcot different from other healthcare software companies? We focus on implementation success, not just code delivery. Our teams include healthcare domain experts who understand clinical workflows, regulatory requirements, and operational realities.

Whether you discovered a technology partner at a conference and need development support, identified gaps in your current healthcare IT stack, or want to build innovative solutions for next year’s exhibitions, Bitcot provides the technical capabilities and healthcare AI expertise required for population health management and predictive analytics.

The conference-to-production challenge: Organizations often return from conferences energized but uncertain how to execute. Vendor promises sound compelling but require careful vetting, integration planning, and phased implementation. We bridge that gap between vision and deployment, turning conference insights into working solutions.

From proof-of-concept to enterprise deployment, Bitcot helps healthcare organizations move faster, avoid costly mistakes, and achieve the outcomes discussed in conference keynotes.

Strengthen Your Strategy with Our Healthcare Software Expertise

$110.61 Billion – Global AI in healthcare market projected value by 2030, growing from $21.66 billion in 2025 at a CAGR of 38.6%.

66% – Physicians used healthcare AI in 2024, marking a 78% increase from just 38% in 2023, showing rapid adoption.

$3.20 ROI – Average return for every $1 invested in healthcare AI, with typical returns realized within just 14 months.

The combination of strategic conference selection and strong execution partnerships creates sustainable competitive advantage. Time to plan your 2026 calendar.

Moving Forward with Conference Strategy

Digital health conferences in 2026 offer unprecedented opportunities for strategic engagement.

From Medicaid Innovations Forum’s concentrated payer access to ViVE’s curated matchmaking to HIMSS’s technical depth to HLTH’s ecosystem-wide reach, the market provides targeted options for every objective.

Technology integration accelerates. Regulatory complexity demands informed leadership. The question isn’t whether to attend conferences. It’s which ones move your business forward.

The conferences highlighted here represent the strongest options across different categories:

- Value-based care and payer strategy: Medicaid Innovations Forum

- Buyer-seller connections: ViVE, Becker’s

- European markets and innovation: health.tech Basel, DMEA

- Technical depth: HIMSS

- Clinical specialization: ACC

- Population health research: Digital Public Health Conference

- Ecosystem-wide innovation: HLTH

- International expansion: HLTH Europe, Arab Health, Digital Health London

Select conferences that align with your business stage, target customers, and strategic priorities.

Early-stage startups seeking funding prioritize HLTH’s investor programs. Growth companies focused on enterprise sales choose ViVE and Becker’s for concentrated buyer access. Established organizations expanding internationally add European and Middle Eastern events.

Success requires strategic participation. Define objectives aligned with business goals. Select conferences matching specific needs. Prepare thoroughly. Execute disciplined follow-up.

The most successful organizations view conferences as catalysts for specific outcomes rather than generic networking. They send right-sized teams, assign clear roles, track measurable results, and convert conversations into business relationships. They plan. They execute. They follow up. They win.

Ready to transform conference insights into deployed solutions? Bitcot’s healthcare software development expertise helps organizations execute on innovations and partnerships discovered at industry events.

Start planning your conference strategy today. Review the events listed here, define clear objectives, and commit to disciplined execution that turns conference investments into business outcomes. The calendar fills fast. Early decisions win.

Questions about implementing digital health solutions from your conference learnings? Contact us to discuss how we can help bring your vision to life.