Let’s be honest: managing accounts payable isn’t anyone’s favorite part of running a business.

Between tracking invoices, chasing approvals, matching POs, and making sure payments go out on time (without errors!), it can feel like a never-ending cycle of manual tasks and stress. And as your company grows, those spreadsheets and email threads that once “worked fine” quickly turn into bottlenecks.

That’s where accounts payable (AP) automation steps in.

Instead of spending hours pushing paper and cross-checking data, automation in accounts payable lets your system do the heavy lifting: capturing invoices, verifying details, routing approvals, and scheduling payments seamlessly. It’s faster, more accurate, and a lot less frustrating.

In this step-by-step guide, we’ll break down exactly how AP automation works, the best accounts payable process automation tools you’ll need, and how to roll it out in your business, without disrupting your existing processes.

Whether you’re tired of manual errors, late fees, or just want your finance team to focus on strategy instead of paperwork, this guide will show you how to make accounts payable smarter, simpler, and fully automated.

What is Accounts Payable Automation?

Accounts payable automation, also called AP automation, is the process of using technology to streamline and digitize every step of your company’s accounts payable workflow, from receiving an invoice to making the final payment.

Instead of relying on paper invoices, manual data entry, and endless email threads, accounts payable automation tools handle repetitive tasks automatically. They can scan and capture invoice data, match it with purchase orders, route approvals to the right people, and even trigger payments once everything checks out.

In simple terms, accounts payable workflow automation replaces tedious, error-prone manual work with a smooth, efficient, and transparent process. It ensures vendors get paid on time, financial data stays accurate, and your team can focus on more important work, like analyzing cash flow and improving supplier relationships.

Here’s what that really means:

- It digitizes the entire payables process: From receiving invoices to completing payments, every step happens electronically. There’s no need for paper invoices, physical filing, or manual routing: everything is processed and stored digitally for faster access and better organization.

- It replaces manual effort with intelligent workflows: Automation handles repetitive tasks like reading invoices, checking details, and routing approvals. The system follows pre-set rules so invoices move through the process automatically, reducing human involvement and delays.

- It ensures accuracy and consistency: By using machine learning and data validation, AP automation tools minimize errors caused by manual entry. Every transaction follows the same process, ensuring consistent handling of invoices and reliable financial data.

- It creates a single source of truth: All invoices, approvals, and payment records live in one centralized system. This means finance teams no longer have to track down emails or files; everything they need is visible and searchable in real time.

- It enhances financial visibility and control: Since every invoice and payment status can be tracked instantly, finance leaders can see what’s pending, what’s paid, and what’s coming up. This makes cash flow forecasting and budget management far more accurate.

- It transforms AP from reactive to strategic: With automation taking care of the routine work, teams can focus on higher-value tasks like negotiating vendor terms, analyzing spending patterns, and improving financial planning.

In essence, accounts payable process automation isn’t just about paying bills faster; it’s about creating a smarter, more transparent, and scalable finance operation that supports the growth of your business. Businesses are rapidly adopting robotic process automation for accounts payable as a powerful tool for enhancing compliance and cutting down operational expenses.

Challenges in Traditional Accounts Payable

Before accounts payable invoice workflow automation, most businesses relied on traditional, manual methods. That usually means piles of invoices, long email threads, and a whole lot of back-and-forth just to get a payment approved.

While this setup might work when you’re small, it quickly becomes chaotic as the number of vendors, invoices, and approval layers grows.

Here’s a closer look at the biggest challenges that come with traditional accounts payable systems:

1. Manual Data Entry and Human Errors

Traditional accounts payable relies heavily on manual data entry: typing in invoice numbers, vendor details, dates, and payment amounts line by line. While it might seem manageable at first, this process is prone to human error. A simple typo or misplaced decimal can result in overpayments, duplicate entries, or mismatched records.

These small errors often snowball into hours of rework and reconciliation, slowing down operations and increasing frustration for both finance teams and vendors.

2. Lost, Misplaced, or Delayed Invoices

When invoices come in through multiple channels: paper mail, PDFs, or email attachments, they can easily get misplaced or overlooked. Without a centralized system, tracking what’s received and what’s pending becomes a guessing game.

Delays in forwarding invoices or missing documentation lead to late payments, missed early-payment discounts, and damaged vendor relationships. It’s not uncommon for finance teams to waste valuable time just searching for invoices instead of processing them.

3. Slow and Inefficient Approval Workflows

Approvals are one of the biggest bottlenecks in a manual AP process. Invoices often sit in inboxes or on desks waiting for signatures from busy managers. If even one person in the chain is out of the office, the entire process can grind to a halt.

There’s little visibility into who’s holding things up, and follow-ups turn into endless email threads. The result? Payment delays, unhappy suppliers, and a finance team constantly chasing approvals.

4. Limited Visibility into Financial Status

Without automation, it’s nearly impossible to get a clear picture of where your money is going in real time. Spreadsheets and static reports can’t provide up-to-date insights into pending invoices, upcoming payments, or overall cash flow.

This lack of visibility makes it harder to plan budgets, manage working capital, or catch issues like duplicate payments early. It also limits your ability to make fast, data-driven financial decisions.

5. Compliance and Audit Challenges

When records are scattered across emails, paper files, and shared drives, maintaining compliance becomes a nightmare. Tracking who approved what, when, and why is difficult without a digital trail. During audits, finance teams scramble to gather documentation, proof of approvals, and payment confirmations, often at the expense of their regular work.

The lack of structured records can expose your business to compliance risks and potential penalties.

6. Poor Vendor Communication and Relationships

Manual AP systems make it tough to keep vendors updated about payment statuses. When suppliers don’t know whether their invoices have been received or when they’ll be paid, they start sending follow-up calls and emails.

This back-and-forth eats into your team’s time and can strain long-term partnerships. A lack of transparency in payment processes often makes vendors less willing to offer flexible terms or discounts in the future.

7. Difficulty Scaling with Business Growth

As your business expands, the volume of invoices grows right along with it. Unfortunately, traditional AP processes don’t scale well. Managing hundreds, or even thousands, of invoices manually each month requires more staff, more time, and more oversight.

Eventually, the process becomes unsustainable, creating bottlenecks that can slow down your entire financial operation.

Benefits of Accounts Payable Automation

Switching from a manual process to an automated accounts payable system isn’t just about saving time; it’s about transforming the way your finance team operates.

An accounts payable automation platform brings speed, accuracy, and visibility to a process that’s often bogged down by delays and manual errors. It lets your business scale smoothly without piling on extra administrative work.

Let’s break down the biggest accounts payable automation benefits:

Faster Invoice Processing

What used to take days, or sometimes weeks, can now be done in minutes. Accounts payable invoice automation tools capture invoice data instantly, route it to the right approver, and schedule payments automatically. No more printing, scanning, or chasing signatures. The entire invoice processing workflow moves faster from start to finish, which means vendors get paid on time.

Improved Accuracy and Fewer Errors

Manual data entry is one of the biggest sources of mistakes in traditional AP. Automation removes that risk by capturing and verifying invoice data automatically. Systems can even perform three-way matching between invoices, purchase orders, and receipts, flagging discrepancies instantly. This not only ensures accurate payments but also builds trust by eliminating the frustration of invoice disputes.

Greater Financial Visibility

With automation, every invoice, approval, and payment is tracked in real time. Finance teams can see exactly what’s pending, what’s approved, and what payments are due. This level of transparency helps in forecasting cash flow, planning budgets, and making better financial decisions. Instead of relying on static spreadsheets, you get a live dashboard that shows your AP performance at a glance.

Cost Savings and Higher Efficiency

By cutting down on manual labor, paper handling, and late payment penalties, automation can significantly reduce operational costs. Businesses often see measurable ROI within months of implementation. Fewer manual tasks also mean your existing staff can handle a larger volume of invoices without hiring additional resources, allowing you to scale efficiently as you grow.

Strengthened Vendor Relationships

Vendors love getting paid on time, and the best accounts payable automation solutions help ensure that happens consistently. With clear payment schedules and fewer invoice disputes, suppliers feel more confident working with you. Some businesses even gain leverage to negotiate early-payment discounts or better terms, since vendors know their invoices are handled promptly and transparently.

Better Compliance and Audit Readiness

Every invoice processed through an accounts payable invoice automation system is recorded with a complete digital trail: who approved it, when it was received, and when it was paid. This makes compliance much easier and speeds up audits dramatically. Instead of digging through folders or email archives, all documentation is just a few clicks away, ensuring full accountability and peace of mind.

Scalable and Future-Ready Operations

As your business grows, so does your volume of payables. With automation, you can easily handle that increase without adding headcount or introducing chaos. The system scales effortlessly, adapting to new vendors, higher invoice loads, and even global payment workflows. It sets the foundation for a finance function that’s efficient, data-driven, and ready for the future.

How Does Accounts Payable Automation Work?

Accounts payable automation works by using specialized software and AI technologies to digitize and automate every step of the invoice processing and payment workflow, from the moment an invoice is received to the final reconciliation. The goal is to create a seamless, “touchless” process.

The accounts payable automation process can be broken down into five key steps:

1. Invoice Capture and Digitization

This is where the invoice is received and converted into machine-readable data, eliminating manual data entry.

- Receipt: The system captures invoices from all sources, whether they arrive via email (PDF attachments), an Electronic Data Interchange (EDI), a supplier portal, or are simply paper invoices scanned by an employee.

- Data Extraction: Optical Character Recognition (OCR) technology, often enhanced by AI & ML, instantly scans the document, identifies the key fields (vendor name, invoice number, amount, date, line items), and converts that information into usable digital data.

- Classification: The system classifies the document (e.g., as a PO invoice, a non-PO invoice, or a credit memo) and organizes it for the next steps.

2. Validation and Matching (Three-Way Match)

The system uses pre-defined business rules to check the legitimacy and accuracy of the captured data.

- Three-Way Match: For invoices related to a purchase order (PO), the system automatically performs a three-way match. It compares the data from the Invoice, the original Purchase Order (PO), and the Goods Receipt Note (GRN) or service confirmation.

- Straight-Through Processing: If all three documents match within a set tolerance, the invoice is immediately validated and approved for payment routing without any human touch. This is known as Straight-Through Processing (STP).

- Exception Flagging: If a discrepancy is found (e.g., the invoice amount is too high, or a corresponding GRN is missing), the system instantly flags it as an exception and routes it to the AP staff for manual review and resolution.

- GL Coding: For non-PO invoices or recurring vendor payments, the system uses historical data and rules to automatically suggest or apply the correct General Ledger (GL) codes.

3. Automated Approval Workflow

Invoices that require human review are digitally routed based on pre-set business logic.

- Rule-Based Routing: The software uses the invoice data (amount, department, vendor) to determine the correct approver(s) according to the company’s organizational chart and spending policy.

- Notifications: The designated approver receives a real-time notification (via email or a mobile app) with a link to the invoice and all supporting documents.

- Tracking and Escalation: The system maintains a complete, timestamped audit trail of the approval process. If an approver is slow to act, automated reminders or escalation rules ensure the invoice is redirected to a backup approver, preventing delays.

4. Payment Execution and Integration

Once the invoice has received final approval, the accounts payable payment automation system prepares and executes the payment.

- ERP Synchronization: The approved and coded invoice data is automatically synced with the company’s Enterprise Resource Planning (ERP) system (like SAP, Oracle, or NetSuite) or accounting software. This eliminates the need for manual data entry into the accounting platform.

- Payment Scheduling: Payments are scheduled based on the due date and any negotiated terms (e.g., to capture early payment discounts).

- Digital Payment: The system initiates the payment electronically through the preferred method, such as ACH, wire transfer, or virtual credit card, ensuring a secure and verifiable transaction.

5. Final Archiving, Reconciliation, and Reporting

The last step ensures data integrity and provides real-time financial visibility.

- Automatic Reconciliation: The system automatically matches the executed payment against the bank statement and the recorded liability, ensuring the books are immediately updated and reconciled.

- Digital Storage: All documents (invoice image, PO, GRN, and approval history) are digitally archived in a centralized, searchable repository, making them easily accessible for audits and compliance checks.

- Real-Time Analytics: The platform provides dashboards with real-time Key Performance Indicators (KPIs), such as invoice cycle time, cost per invoice, and days payable outstanding (DPO), giving finance leaders deep insight into spending and efficiency.

For a successful implementation, finance leaders must adhere to established accounts payable automation best practices, including securing executive buy-in and mapping workflows before adopting new technology.

Which Accounts Payable Tasks are Best for Automation?

Automation is the single most effective way to transform your AP department from a cost center into a strategic operation. To maximize the return on your investment, you should focus your automation efforts on tasks that are repetitive, high-volume, and governed by strict, consistent rules.

These are the areas where human error and processing time can be drastically reduced.

Core Automation Target: Invoice Data Capture & Entry

This is typically the first and most critical step for automation.

- The Pain Point: Manually receiving, sorting, and typing data from various invoice formats (PDFs, paper, emails) is slow, tedious, and highly susceptible to typos. A single misplaced digit can derail the entire process.

- The Automation Solution: Modern AP software uses Optical Character Recognition (OCR) and AI to read and extract key information, like vendor name, invoice amount, due date, and line-item details, directly from the document. The data is then instantly validated against existing vendor records.

- The Benefit: Processing time drops from days to mere minutes, virtually eliminating data entry errors at the source.

Verifying Payments: The Power of Three-Way Matching

For companies that use Purchase Orders (POs), the three-way match is a mandatory control procedure that is perfectly suited for automation.

- The Task: A human accountant must compare three distinct documents: the Purchase Order (PO), the Goods Receipt Note (GRN) (or service acceptance confirmation), and the Vendor Invoice. If the quantity and price on all three match, the invoice is cleared for payment.

- The Automation Solution: An AP automation platform can perform this comparison instantly. If the system finds an exact match, it automatically approves the invoice. If there’s a variance that falls within a pre-defined tolerance (e.g., less than a $50 difference), it can auto-approve with an exception flag.

- The Benefit: This dramatically speeds up verification, ensures payment accuracy, and acts as a powerful deterrent against fraud by ensuring only valid, ordered, and received goods are paid for.

Streamlining Internal Review: Workflow Routing & Approvals

Manual approval processes often involve printouts, desk-to-desk walking, or endless email chains, the primary causes of payment delays.

- The Task: Getting the invoice approved by the correct budget owner or manager based on the dollar amount, department, or specific vendor.

- The Automation Solution: The system is configured with pre-set business rules. Once the invoice data is captured, it is automatically routed to the right approver’s digital inbox. Approvers can review and approve from a desktop or mobile device. Escalation rules can be set to automatically redirect the invoice if an approver is out of the office or delays their action.

- The Benefit: Total transparency and accountability. You always know where an invoice stands, and approval cycles are compressed from weeks to hours, allowing you to capture valuable early payment discounts.

Final Steps: GL Coding, Payment, and Reconciliation

The final mile of the AP process is just as important to automate for efficiency and data integrity.

- General Ledger (GL) Coding: For recurring invoices, the appropriate account code can be automatically suggested or applied based on historical data. This ensures consistent and accurate financial reporting.

- Payment Execution: Once fully approved, the system can automatically initiate the payment via the preferred method (ACH, wire, virtual card) and record the transaction in your Enterprise Resource Planning (ERP) system.

- Reporting & Exception Handling: The system handles the simple, compliant transactions, but also automatically identifies and flags exceptions (e.g., a three-way mismatch or an invoice with an invalid vendor ID). This allows AP staff to stop performing manual grunt work and focus on the high-value activity of resolving complex issues.

By automating these high-volume, rules-based tasks, AP teams are freed up to become true financial strategists, contributing to better cash flow management and stronger vendor relationships.

How to Automate Accounts Payable in 3 Phases?

Automating your accounts payable function is a structured transformation project, not just installing the top accounts payable automation software.

A successful transition requires careful planning, stakeholder buy-in, and a focus on process optimization before the technology is even switched on.

Here is a step-by-step guide to successfully automating your AP process:

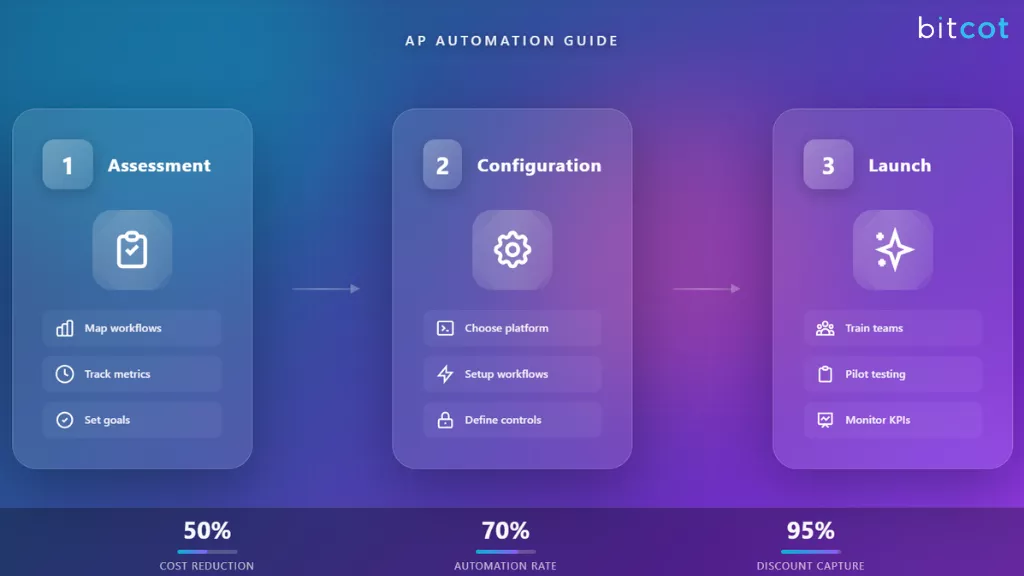

Phase 1: Assessment and Strategy

The initial phase is about understanding your starting point and defining your desired future state.

Step 1: Map Your Current “As-Is” Workflow and Identify Pain Points

Before you can fix something, you need to understand exactly how it works today.

- Audit Everything: Visually map the journey of an invoice from the moment it is received (paper mail, email, or portal upload) to the final reconciliation.

- Quantify Inefficiencies: Calculate key metrics (KPIs) like:

- Cost per Invoice: The true labor and materials cost to process a single invoice.

- Invoice Cycle Time: The average time it takes for an invoice to be paid after receipt.

- Exception Rate: The percentage of invoices that require manual intervention (e.g., incorrect data, missing PO).

- Gather Feedback: Talk to your AP team, department managers, and approvers to pinpoint bottlenecks, common errors, and areas of frustration. These pain points will become your target areas for automation.

Step 2: Set Clear, Measurable Goals (Your “To-Be” State)

Based on your pain points, define what success looks like. These goals will guide your software selection and configuration.

- Example Goals: Reduce the average cost per invoice by 50% in the first year; Capture 95% of early payment discounts; Achieve a 70% straight-through processing rate (STP) for PO invoices.

Step 3: Standardize and Simplify Existing Processes

Automation cannot fix a broken process; it only automates the breakage. Take time to clean up your internal data.

- Clean Master Data: Ensure vendor names, addresses, and payment terms in your system are accurate and consistent.

- Standardize PO Processes: Encourage or enforce the use of Purchase Orders (POs) across the company, as PO-based invoices are the easiest to automate.

- Simplify Approval Hierarchy: If your approval workflow has too many unnecessary steps or layers, simplify the chain before digitizing it.

Phase 2: Selection and Configuration

This phase involves choosing the right accounts payable automation technology and setting it up to match your new, simplified processes.

Step 4: Choose the Right AP Automation Solution

Select a platform based on your specific needs, focusing on four core features:

- ERP/Accounting Integration: The solution must seamlessly connect with your existing ERP or accounting software (e.g., QuickBooks, SAP, NetSuite) to ensure real-time data sync.

- AI-Powered Data Capture: Look for best-in-class OCR and machine learning for high-accuracy invoice extraction across various file types.

- Configurable Workflows: The system must allow you to customize routing rules to reflect your specific approval limits, departments, and compliance rules.

- Scalability and Support: Choose a vendor that can grow with your company and offers robust implementation support and training.

Step 5: Configure Workflows and Controls

This is the technical setup phase where you translate your business rules into system rules.

- Map Digital Workflows: Set up the automated approval paths, defining who approves an invoice based on cost center, amount threshold, or vendor.

- Define Matching Rules: Configure the exact matching criteria for your 2-way and 3-way matches (e.g., Allow up to a $100 variance on price).

- Set Compliance Guardrails: Program the system to enforce segregation of duties (SoD) and flag transactions that violate internal controls or tax compliance rules.

Phase 3: Launch and Optimization

The final phase focuses on change management, testing, and ensuring long-term success.

Step 6: Secure Cross-Functional Buy-In and Train Your Team

Technology adoption is often the biggest hurdle. You must involve employees from day one.

- Appoint Champions: Identify “super users” within the AP and Finance teams who can advocate for the new system and support their colleagues.

- Train by Role: Provide tailored training sessions for different users: AP staff need to know data capture and exception handling; Approvers need to know how to use the mobile approval interface.

- Communicate the Why: Clearly explain to all employees how automation benefits them, reducing manual data entry, providing better visibility, and creating more strategic roles.

Step 7: Phased Rollout and Testing

Avoid a “big bang” rollout. Start small to minimize risk.

- Pilot Project: Begin with a small set of vendors or a single, low-risk department. Process invoices through both the old manual system and the new automated system to compare results and validate accuracy.

- Integration Testing: Thoroughly test the data transfer between the AP platform and your ERP/accounting system to ensure data integrity and zero errors.

Step 8: Monitor, Measure, and Optimize

Implementation is not the end; it’s the start of continuous improvement.

- Monitor KPIs: Track the metrics you defined in Step 2 (e.g., invoice cycle time, cost per invoice). Celebrate early successes to maintain momentum.

- Leverage Analytics: Use the platform’s reporting tools to identify new bottlenecks or high exception rates and adjust your workflows accordingly.

- Vendor Onboarding: Communicate the new process to your suppliers, ideally encouraging them to use e-invoicing or a vendor portal to maximize your system’s “touchless” capabilities.

By following these steps, you can implement accounts payable process automation in a structured way that reduces errors, accelerates payments, and gives your finance team more time to focus on strategic priorities rather than repetitive administrative tasks.

Partner with Bitcot to Build a Custom Accounts Payable Automation Solution

Every business has unique accounts payable processes, and what works for one company may not fit another. That’s why a one-size-fits-all solution from accounts payable automation vendors often falls short.

If off-the-shelf accounts payable automation solutions don’t fully address the complexities and unique requirements of your business, partnering with a custom software development firm like Bitcot offers a tailored pathway to AP automation.

A custom solution, built specifically for your business, allows you to integrate complex business logic, leverage existing infrastructure, and achieve a truly “touchless” processing rate that standard platforms often can’t match.

Here’s what you gain from a custom approach to accounts payable automation systems:

| Feature | Custom Solution Benefit | Off-the-Shelf Limitation |

| Deep Integration | Seamless, two-way data sync with all legacy systems, custom ERPs, and industry-specific tools. | Integrations are limited to popular ERPs and often require workarounds for proprietary systems. |

| Tailored Workflows | Workflow rules can incorporate highly specific logic (e.g., If invoice is from Vendor X and over $50k, require VP approval PLUS a security audit). | Workflows are template-based and may not allow for highly complex or conditional logic. |

| Data Extraction (AI/ML) | Custom-trained AI/ML models can achieve near-perfect OCR accuracy for highly variable or unique invoice formats common in your industry. | Generic OCR models struggle with unstructured invoices, handwriting, or industry-specific fields. |

| Scalability & Cost | The system is built to scale precisely with your transaction volume, resulting in predictable long-term costs. | Subscription costs often escalate sharply with increasing transaction volume or number of users. |

| Security & Compliance | Security protocols are designed to meet your exact corporate and regulatory compliance standards (e.g., SOC 2, specific regional tax laws). | Security features are generic and may require manual oversight to ensure specialized compliance. |

With Bitcot, a reputed AI automation agency, you can build a custom accounts payable automation system tailored to your workflow, team structure, and vendor requirements.

Our team of experts works closely with your finance department to understand your current challenges, map out your AP workflow, and identify areas where automation can deliver the most value.

For example, we recently partnered up with a client for the successful automation of accounts payable process, leading to a 60% reduction in invoice processing time and a significant decrease in costly human errors, by leveraging healthcare accounts payable automation.

From invoice capture and approval routing to payment scheduling and reporting, we design a B2B accounts payable automation solution that streamlines every step of your AP process while integrating seamlessly with your existing accounting or ERP systems.

When it comes to accounts payable automation for small business operations, our approach ensures that the system is not only efficient but also scalable, so it grows with your business.

You’ll gain real-time visibility, error-free processing, and a digital audit trail that makes compliance and reporting easier than ever. Plus, with our accounts payable automation services, your finance team can shift their focus from manual tasks to strategic financial planning and decision-making.

Partnering with Bitcot means more than just building accounts payable automation solutions; it’s a collaborative journey to transform your AP into a faster, smarter, and fully automated operation.

Final Thoughts

The era of Accounts Payable as a purely transactional, back-office function is over.

As modern financial leaders, our focus must shift from merely processing invoices to leveraging AP as a strategic intelligence hub. The cost of inertia is simply too high: manual processes breed errors, stifle cash flow visibility, and leave the organization vulnerable to fraud.

Automation of accounts payable, therefore, is not a luxury; it is the non-negotiable first step toward financial agility. By embracing accounts payable automation AI systems, companies move from an average invoice processing cost of $15 and a cycle time measured in weeks, down to a cost of a few dollars and a cycle time measured in hours.

This newfound efficiency isn’t just about saving labor; it’s about unlocking growth. It enables the AP team to evolve from data entry specialists to strategic analysts, focusing on vendor relationships, spend optimization, and accurate forecasting.

The true future of AP is not just automated; it is intelligent.

The most successful finance departments will be those that integrate smart, decision-making AI agents into their workflows to handle complex exceptions, perform instantaneous three-way matching, and enforce compliance with minimal human touch. This is the pathway to achieving true financial control and audit-readiness in a complex global market.

To see how you can apply goal-oriented artificial intelligence and cutting-edge platforms to create an autonomous AP workflow, dive deeper into the next generation of the best accounts payable automation:

For a deeply integrated system tailored to your specific organizational needs, partner with Bitcot for specialized accounts payable workflow automation services and build the autonomous AP solution that will define your financial future.

Get in touch with our team.